Jazz Pharmaceuticals

JAZZ

announced that it has entered into a licensing agreement with

Werewolf Therapeutics

HOWL

to gain rights to the latter’s pre-clinical oncology candidate WTX-613.

Werewolf’s pipeline candidate WTX-613 is an engineered cytokine pro-drug that gets activated specifically within the tumor microenvironment and stimulates particular receptors, such as interferon alpha 2b on cancer-fighting immune effector cells.

Per Jazz management, WTX-613 has the potential to treat a wide range of cancer types in different stages and also in combination with other cancer therapies, including immune checkpoint inhibitors, targeted therapies and chemotherapy.

Werewolf’s WTX-613 demonstrated anti-tumor activity in preclinical models. Jazz expects to submit an investigational new drug (IND) application to the FDA in 2023 to support initiation of a clinical study on the candidate.

Per the terms of the agreement, Jazz will pay $15 million of upfront payment to Werewolf. JAZZ will also pay up to $1.26 billion as development, regulatory and sales milestone fees as well as royalties on the potential sales to Werewolf.

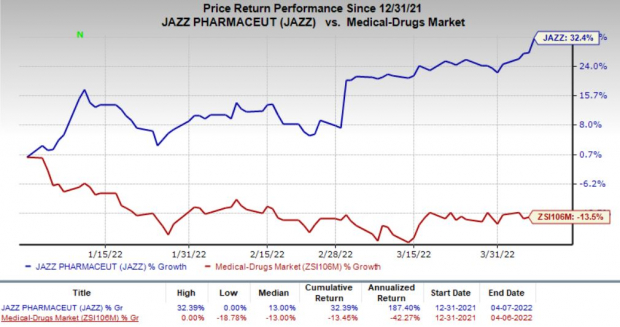

Shares of Jazz have risen 32.4% against the

industry

’s decrease of 13.5%.

Image Source: Zacks Investment Research

Jazz derives majority of its revenues from its sleep disorder portfolio, which is included in its Neuroscience portfolio. JAZZ diversified its Neuroscience portfolio in 2021 with the acquisition of the British cannabinoid drug company GW Pharmaceuticals. The buyout added epilepsy and multiple sclerosis drugs to its portfolio.

Jazz has been diversifying into the oncology segment for the past few years through inorganic as well as organic growth. JAZZ’s oncology portfolio has marketed drugs. It has constantly focused on expanding the label of its marketed drugs that boosted its oncology revenues and the trend will likely continue.

The licensing agreement with Werewolf will add a promising candidate to its pipeline, which Jazz believes, provides it with an opportunity to expand into immuno-oncology. Management also states that the agreement will support JAZZ’s plan to deliver at least five additional novel therapies to patients by the end of the decade.

Zacks Rank & Stocks to Consider

Jazz currently carries a Zacks Rank #3 (Hold). Two better-ranked stocks from the same sector are

Collegium Pharmaceutical

COLL

and

Assertio Holdings

ASRT

, each currently sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

The Collegium stock has risen 9.2% so far this year. The Zacks Consensus Estimate for COLL’s 2022 earnings has gone up from $3.79 to $5.59 over the past 60 days.

Collegium beat earnings estimates in one of the trailing four quarters and missing the mark on three occasions. COLL delivered a negative earnings surprise of 57.55%, on average.

Estimates for Assertio Holdings’ 2022 earnings have improved from 20 cents per share to 35 cents per share over the past 60 days. The stock has gained 22.1% so far this year.

Assertio Holdings beat earnings estimates in two of the trailing four quarters and missed the mark twice. ASRT delivered an earnings surprise of 20.83%, on average.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report