Jazz Pharmaceuticals

JAZZ

announced that its phase III study — RELEASE MSS1 — evaluating nabiximols oromucosal spray (Sativex in ex-U.S. markets) for clinical measures of spasticity in individuals with multiple sclerosis (MS) failed to meet its primary endpoint. The study’s primary endpoint was a change in Lower Limb Muscle Tone-6 (LLMT-6) from baseline to day 21, as measured on the Modified Ashworth Scale (MAS).

The nabiximols oromucosal spray is a cannabis-based therapy that is approved as Sativex in 29 countries for the treatment of adult patients with moderate-to-severe spasticity due to MS in patients who had inadequate response following treatment with other anti-spasticity medication. Jazz added Sativex to its portfolio with the acquisition of British cannabinoid drug company, GW Pharmaceuticals last year.

Jazz plans to present data from the RELEASE MSS1 study at a future medical meeting.

The company is evaluating nabiximols oromucosal spray in two other late-stage studies — RELEASE MSS3 and RELEASE MSS5 — in MS patients. Data from these studies will support the overall registrational program in the United States for nabiximols oromucosal spray.

The RELEASE MSS3 study is evaluating the addition of nabiximols oromucosal spray to standard-of-care for the improvement of muscle spasms associated with MS over a 12-week treatment period. The other late-stage is evaluating the effect of multiple doses of nabiximols oromucosal spray on a clinical measure of velocity-dependent muscle tone in LLMT-6 in MS patients versus placebo.

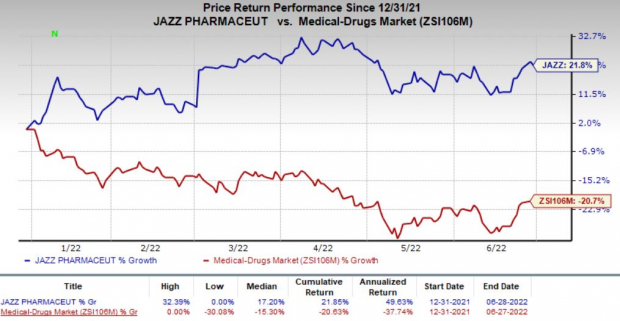

Shares of Jazz have risen 21.8% so far this year against the

industry

’s decrease of 20.7%.

Image Source: Zacks Investment Research

Jazz derives the majority of its revenues from its sleep disorder portfolio, which is included in its Neuroscience portfolio. JAZZ diversified its Neuroscience portfolio in 2021 with the acquisition of GW Pharmaceuticals. The buyout added epilepsy and multiple sclerosis drugs to its portfolio.

Jazz has been diversifying into the oncology segment for the past few years through inorganic as well as organic growth. JAZZ’s oncology portfolio has marketed drugs. It has constantly focused on expanding the label of its marketed drugs that boosted its oncology revenues and the trend will likely continue. Jazz added a pre-clinical oncology candidate WTX-613 to its pipeline earlier this month through a licensing agreement with

Werewolf Therapeutics

HOWL

.

Werewolf’s pipeline candidate WTX-613 is an engineered cytokine pro-drug that gets activated specifically within the tumor microenvironment and stimulates particular receptors. Per Jazz management, Werewolf’s WTX-613 has the potential to treat a wide range of cancer types in different stages and also in combination with other cancer therapies, including immune checkpoint inhibitors, targeted therapies and chemotherapy.

Jazz also sold rights to one of its new sleep drugs, Sunosi to

Axsome Therapeutics

AXSM

to focus on its highest strategic priorities designed to deliver sustainable growth and enhanced shareholder value. Axsome will pay JAZZ royalties on net sales of Sunosi going forward.

Zacks Rank & Stock to Consider

Jazz currently carries a Zacks Rank #3 (Hold).

Assertio

ASRT

is a better-ranked in the same sector, sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

The Zacks Consensus Estimate for Assertio’s earnings has improved 14.3% for 2022 and 480% for 2023 over the past 60 days. The stock has gained 30.7% so far this year.

Assertio’s earnings surpassed estimates in two of the trailing four quarters and missed the same twice, with average beat of 26.39%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report