JinkoSolar Holding Co., Ltd

.’s

JKS

subsidiary, Jinko Solar Co, recently inked a deal to supply solar modules for Phase l of the Santa Luzia Complex Project in Paraíba State, Brazil.

Per the deal, the company will provide 522 megawatts (MW) of Tiger Neo 78 Cell modules for the project under construction in Brazil, thus tapping the growth of the expanding Brazilian solar market with its high-performance modules.

Jinko Solar Strong Product Offerings

Per a report from Fortune Business Insights, the global solar market is projected to witness a CAGR of 6.9% over the 2021-2028 period. This exemplifies strong growth prospects for companies in the solar landscape as nations across the globe hunt for eco-friendly ways of energy production.

In this context, JinkoSolar is one of the largest and most innovative solar module manufacturers in the world and may reap the benefits of the strong demand with its attractive product line-up. The capability of its product portfolio can be gauzed through its demand as one out of every 10 solar modules installed worldwide is manufactured by JinkoSolar.

Furthermore, Jinko Solar’s continuous focus on evolving in the solar market by introducing technologically advanced products in a bid to meet the requirements of the changing dynamics of the solar world has been even more instrumental to its growth trajectory.

In the light of aforementioned factors, its new series of ultra-efficient Tiger Neo modules, the Tiger Neo series, boasts capabilities that make it one of the most proficient solar modules in the market to date.

Such an efficient product lineup may witness consistent strength in the long haul amid the rising demand for renewable sources of energy worldwide to meet clean energy goals.

Peer Moves

Other solar companies that have an established position in the global solar market and can enjoy the perks of increased demand are:

SolarEdge Technologies

’

SEDG

optimized inverter solutions address a broad range of solar market segments. In the third quarter, the company witnessed record solar revenues, driven by the strong demand for its solar products across all segments and geographies.

SolarEdge registered record revenues in 14 European countries, most notably in Germany, the Netherlands, France and the U.K. The long-term (three to five years) earnings growth rate of SolarEdge stands at 31.8%. Shares of SEDG have risen 7.7% in the past six months.

Canadian Solar

CSIQ

has one of the world’s largest utility-scale solar project development platforms. It caters to a geographically diverse customer base across key markets in the United States, China, Japan, the U.K. and Canada, and emerging markets in Brazil, India, Mexico, Italy, Germany, South Africa and the Middle East.

The Zacks Consensus Estimate for Canadian Solar’s 2022 sales indicates an improvement of 39.1% over the prior-year reported figure. Shares of CSIQ have increased 14.2% in the past six months.

ReneSola

SOL

continues to benefit from a steady flow of contracts from domestic and international customers. With the successful execution of its downstream strategy, SOL is currently expanding its business in international markets. It is committed to adding an incremental project pipeline to its core markets, including the United States, the U.K., Spain, Poland, France, Germany and Hungary.

The Zacks Consensus Estimate for 2022 sales suggests a growth rate of 34.2% from the prior-year reported figure. ReneSola shares have increased 5.1% in the past month.

Price Movement

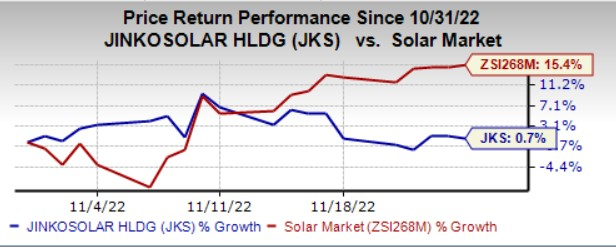

In a month, shares of JinkoSolar have increased 0.7% compared with the

industry

’s growth of 15.4%.

Image Source: Zacks Investment Research

Zacks Rank

JinkoSolar currently carries a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report