Shares of

Matinas BioPharma

MTNB

were up 23.2% on Monday after it announced that it has signed a research collaboration agreement with

BioNTech

BNTX

.

Per the collaboration agreement, Matinas BioPharma will work exclusively with BioNTech to evaluate a novel delivery technology for mRNA-based vaccines leveraging the Matinas BioPharma’s proprietary lipid nanocrystal (LNC) platform technology. As part of the deal, both BNTX and MTNB will also work to make the oral novel mRNA-based vaccines.

Both Matinas BioPharma and BioNTech will work closely with each other on formulation, optimization and in vitro testing.

Per the terms of the agreement, Matinas BioPharma will receive an undisclosed fee as upfront payment and will also be eligible to receive additional research funding from BioNTech. The press release did not disclose any specific terms of the deal. Both companies also started discussions on licensing agreements for MTNB’s LNC platform.

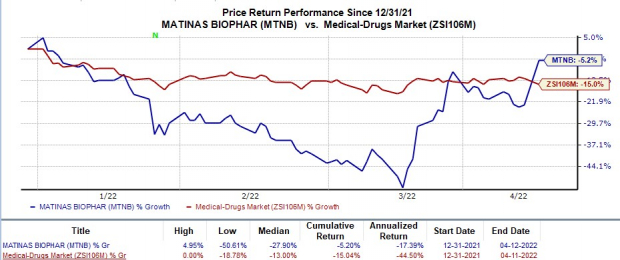

Shares of Matinas BioPharma have declined 5.2% so far this year compared with the

industry

’s 15% decrease.

Image Source: Zacks Investment Research

Currently with no approved product in its portfolio, Matinas BioPharma is highly dependent on its pipeline development for growth. Using its LNC technology, MTNB developed two potent anti-infective small molecules, namely MAT2203 and MAT2501. Funds from the above partnership will help MTNB support its pipeline development.

MAT2203 is Matinas BioPharma’s lead drug and is the oral formulation of amphotericin B, a well-known and highly effective antifungal drug. This oral formulation is currently being evaluated in a phase II study in multiple cohorts for the treatment of cryptococcal meningitis. Matinas BioPharma plans to meet with the FDA officials in second-quarter 2022 to discuss the requirements of a regulatory filing for the candidate.

MTNB’s second candidate is MTA2501 (oral amikacin), currently being evaluated in an early-stage study for the treatment of non-tuberculous mycobacterial (NTM), a severe lung infection. Data from this study is expected in second-quarter 2022.

Zacks Rank & Other Key Picks

Matinas BioPharma presently carries a Zacks Rank #2 (Buy). Some other top-ranked stocks in the overall healthcare sector are

Angion Biomedica

ANGN

and

Collegium Pharmaceutical

COLL

, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Angion Biomedica’s loss per share estimates for 2022 have narrowed from $2.52 to $1.92 in the past 60 days. The same for 2023 has narrowed from $3.11 to $2.19 in the past 60 days.

Earnings of Angion Biomedica beat estimates in three of the last four quarters and missed the mark in one, the average surprise being 47.5%.

Collegium Pharmaceutical’s earnings per share estimates for 2022 have increased from $3.79 to $5.59 in the past 60 days. The same for 2023 has increased from $4.79 to $7.44 in the past 60 days. Shares of COLL have risen 5.3% year to date.

Earnings of Collegium Pharmaceutical missed estimates in three of the last four quarters and beat the mark on one occasion, the negative surprise being 57.6%, on average.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report