Medtronic plc

MDT

recently announced that the U.S. Centers for Medicare & Medicaid Services (“CMS”) will increase Medicare coverage for all kinds of continuous glucose monitors (CGMs), including adjunctive and non-adjunctive CGMs. The expanded Medicare coverage includes CGMs that can be integrated with Medtronic insulin pumps.

The proposed rule was finalized on Dec 21, 2021, and will take effect beginning 60 days after official publication. It is worth noting that until the ruling takes effect, Medtronic will continue to offer its CGM Access Discount to all Medicare customers.

The new rule from CMS is likely to bolster Medtronic’s Diabetes business, as this will provide expanded access to the company’s diabetes care products.

Enhanced Access to Medtronic Insulin Pumps

Per Medtronic’s management, CMS’ efforts to assist more individuals with diabetes and empower them to choose the therapies that best suit their diabetes management requirements, are laudable. The expanded coverage will benefit the company’s customers who have seen significant clinical and quality of life improvements with the integrated Medtronic insulin pump systems and can avail coverage for all components of their system on Medicare.

Image Source: Zacks Investment Research

The expanded coverage also ensures therapy continuation for those using certain Medtronic insulin pump systems, including the Medtronic hybrid closed loop systems, and currently transferring to Medicare.

Industry Prospects

Per a report

published in Grand View Research, the global continuous glucose monitoring device market is expected to see a CAGR of 10.1% during 2021-2028. Factors such as growing incidence of diabetes, a surge in geriatric population susceptible to diabetes, growing awareness about diabetes preventive care, novel product launches and supportive government initiatives are contributing to market growth.

Given the substantial market prospects, Medtronic stands to gain from the recently expanded Medicare coverage to include CGMs that integrate with the company’s insulin pumps.

Notable Developments

Medtronic has engaged in a number of significant developments in December 2021.

The company gained FDA 510(k) clearance for its INVOS 7100 cerebral/somatic oximetry system for pediatric indications. The INVOS system helps pediatric clinicians to make time-sensitive decisions regarding hemodynamic management, ventilation, and resuscitation for premature infants, neonates, children and other patients treated by them.

Medtronic’s subsidiary, Medtronic Canada ULC, received a Health Canada license for the Hugo robotic-assisted surgery (“RAS”) system for utilization in urologic and gynecologic laparoscopic surgical procedures. The Hugo RAS system is a modular, multi-quadrant platform that brings together wristed instruments, 3D visualization and a cloud-based surgical video capture option in Touch Surgery Enterprise.

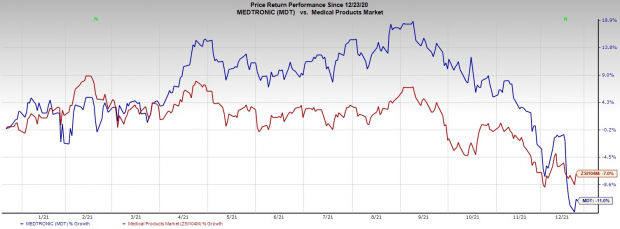

Share Price Performance

The stock has underperformed its

industry

over the past year. It has declined 11% compared with the industry’s 7% fall.

Zacks Rank and Key Picks

Currently, Medtronic carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical space are

Apollo Endosurgery, Inc.

APEN

,

McKesson Corporation

MCK

and

Thermo Fisher Scientific Inc.

TMO

, each carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Apollo Endosurgery has a long-term earnings growth rate of 7%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 25.6%, on average.

Apollo Endosurgery has outperformed its industry over the past year. APEN’s shares have gained 126.3% versus the 7.2% industry growth.

McKesson has a long-term earnings growth rate of 9%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 19.9%, on average.

McKesson has outperformed its industry over the past year. MCK stock has gained 39.1% versus the 13.8% industry rise.

Thermo Fisher has a long-term earnings growth rate of 14%. The company surpassed earnings estimates in the trailing four quarters, delivering an average surprise of 9%.

Thermo Fisher has outperformed its industry over the past year. TMO’s stock has rallied 42.2% versus the industry’s 7.2% rise.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report