Medtronic plc

MDT

recently announced three-month favorable results from an on-label, prospective, multi-center study showing meaningful pain relief using DTM SCS endurance therapy. Notably, DTM SCS endurance therapy is a modified, lower-energy variation of the company’s Differential Target Multiplexed (DTM) Spinal Cord Stimulation (SCS) therapy for chronic overall, back or leg pain.

Modeling based on actual three-month data demonstrates that DTM SCS endurance therapy allows 5.5-7.5 years of device longevity when programmed on the Vanta recharge-free neurostimulator. DTM SCS endurance therapy allows long-lasting recharge-free performance on Vanta and 5-minute recharge on Intellis neurostimulators.

The recent development is likely to fortify Medtronic’s Neuromodulation business, which is part of its Neuroscience Portfolio.

Study Details

Patients treated with DTM SCS endurance therapy demonstrated meaningful pain relief as measured by a 3.9 cm reduction in overall pain on the 10 cm Visual Analog Scale (VAS) at three months. They also reported an average 4.3 cm decrease in back pain and an average 5.0 cm decrease in leg pain.

These three-month results are consistent with data from a prior feasibility study. Additional data included 69% of patients improved to a less disabled category as measured by the Oswestry Disability Index, with 63% having a minimal or moderate disability at three months compared to 16% at baseline. Additionally, 75% of patients were “very satisfied” or “somewhat satisfied” with their therapy at three months.

Significance of the DTM SCS Endurance Therapy

Per personnel associated with the study, the three-month results are highly encouraging, as they demonstrate that the DTM SCS endurance therapy may be able to provide effective pain relief while dosing at lower energy than other SCS waveforms. This will improve device longevity and provide validation of therapy for the patients in need.

Image Source: Zacks Investment Research

Per Medtronic’s management, the new DTM SCS endurance therapy offers meaningful clinical benefits by reducing pain, improving quality of life, and offering meaningful device longevity for patients, especially those who need or prefer a recharge-free SCS solution.

Industry Prospects

Per a report by Fortune Business Insights

, the global spinal cord stimulation market was $2.41 billion in 2020 and is projected to reach $4.12 billion by 2027 at a CAGR of 8%. An increasing number of SCS implantation is driving the market.

Notable Developments

In September 2021, Medtronic announced the latest additions to its minimally-invasive spine surgery ecosystem, making it the only company to combine spinal implants, biologics, navigation, robotics, and AI-powered data for surgeons and patients. The new additions to Medtronic’s MIS+ portfolio create a complete MIS+ TLIF solution for surgeons.

In the same month, Medtronic announced the receipt of CE Mark approval for its radial artery access portfolio, which includes the Rist 079 Radial Access Guide Catheter and Rist Radial Access Selective Catheter. The Rist 079 Radial Access Guide Catheter is the first catheter intended explicitly for the unique demands of accessing the neuro vasculature through the radial artery versus access through the transfemoral artery.

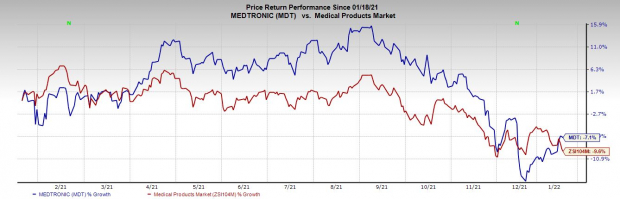

Price Performance

Shares of the company have lost 7.1% in a year compared with the

industry

‘s decline of 9.6%.

Zacks Rank and Key Picks

Medtronic currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A few better-ranked stocks in the broader medical space that investors can consider are

AMN Healthcare Services, Inc.

AMN

,

Apollo Endosurgery, Inc.

APEN

and

Laboratory Corporation of America Holdings

LH

.

AMN Healthcare, carrying a Zacks Rank #1, has a long-term earnings growth rate of 16.2%. AMN Healthcare surpassed earnings estimates in the trailing four quarters, delivering a surprise of 19.5%, on average.

AMN Healthcare has outperformed its industry over the past year. AMN has gained 50% versus the 56.5% industry decline.

Apollo Endosurgery, carrying a Zacks Rank #1, has a long-term earnings growth rate of 7%. Apollo Endosurgery’s earnings surpassed estimates in the trailing four quarters, delivering a surprise of 25.6%, on average.

APEN has outperformed its industry in the past year. It has gained 51.6% versus the industry’s 3.9% fall.

Laboratory Corporation surpassed earnings estimates in each of the trailing four quarters, the average surprise being 25.7%. Laboratory Corporation currently sports a Zacks Rank #1.

LH’s long-term earnings growth rate is estimated at 10.6%. The company’s earnings yield of 9.4% compares favorably with the industry’s 3.4%.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report