Shares of companies like

Emergent BioSolutions

EBS

and

SIGA Technologies

SIGA

, which cater to the biodefense market and make medicines/vaccines to treat smallpox, were up on Thursday as fears of a monkeypox outbreak in Europe increased and one case was reported in the United States. Monkeypox is a rare but potentially serious viral illness with fever-like symptoms and rashes on the face and body.

Emergent BioSolutions stock was up almost 12% while SIGA Technologies rose 17.1% on Thursday.

The monkeypox virus belongs to the same family of viruses that causes smallpox. Symptoms of monkeypox are similar to smallpox though less severe. In the United States, the case of monkeypox was confirmed in a man who had recently traveled to Canada. Per the US Centers for Disease Control and Prevention, the current monkeypox case does not pose a public health risk. Small monkeypox outbreaks have been reported in some European countries like the United Kingdom, Spain, Portugal, though this disease hardly shows up in countries outside Africa.

Emergent makes ACAM2000, a vaccine for smallpox that could be used to treat monkeypox. Moreover, last week, Emergent announced a deal with

Chimerix

CMRX

to acquire exclusive worldwide rights to CMRX’s smallpox oral antiviral product, Tembexa. The FDA approved Chimerix’s Tembexa in June 2021. The transaction is expected to be closed as early as the second quarter of 2022.

Increase demand for ACAM2000 vaccine and potentially Tembexa may help Emergent make profits if the monkeypox infection spreads further.

SIGA Technologies makes an oral antiviral drug called Tpoxx ((tecovirimat), which is approved in the United States, Canada and Europe for the treatment of smallpox. Oral Tpoxx is also approved in Europe for treating monkeypox. On Thursday, the FDA approved an intravenous (IV) formulation of Tpoxx that will help SIGA Technologies to cater to a broader patient population.

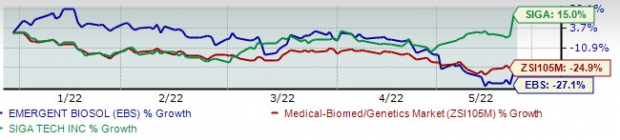

Shares of Emergent BioSolutions have declined 27.1% in the year so far while Siga Technologies stock is up 15%. The

industry

has witnessed a 24.9% decrease in the said time frame as given in the chart below.

Image Source: Zacks Investment Research

Zacks Rank

Currently, Emergent BioSolutions has a Zacks Rank #5 (Strong Sell) while SIGA Technologies has a Zacks Rank of 4 (Sell).

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report