Last week, several natural gas stocks were among the market’s best performers. Lingering positive momentum from the commodity fueled gains in the space along with a key agreement between the United States and the European Union (EU). Futures for April delivery ended Friday at $5.571 on the New York Mercantile Exchange, rising around almost 15% from the previous week’s closing. Building on this narrative, stocks of gas-focused equities like

Tellurian Inc.

TELL

,

Southwestern Energy

SWN

,

EQT Corporation

EQT

,

Range Resources

RRC

and

Cheniere Energy

LNG

rose sharply.

What Drove the Rally?

Investors might note that changes in temperature and weather forecasts can precipitate natural gas price swings. The latest models anticipate strong temperature-driven consumption over the next few weeks (especially in the Midwest and the Northeast), which is a positive for prices. A cold front is expected to push across the Midwest and Northeast over the next few days, leading to a spike in heating load demand.

Natural gas also remained supported by a stable demand catalyst in the form of continued strong liquefied natural gas (LNG) feedgas deliveries. LNG shipments for export from the United States have been robust for months on the back of environmental reasons and record-high prices of the super-chilled fuel elsewhere. Now, with the Russia-Ukraine conflict, LNG is set to become even more coveted. As a matter of fact, the United States entered into a partnership with the EU on Friday to export additional LNG to wean the bloc off its dependence on Russian natural gas supplies. This means LNG deliveries are poised to rise further.

Looking at the supply side, production levels have remained around 3 billion cubic feet (Bcf) below the peak levels achieved in early-2022 and late-2021. Last week, natural gas output averaged 94 Bcf per day, well under the 97 Bcf per day high of late 2021. With the big upstream operators concentrating on free cash flow over production, volumes seem unlikely to recover soon.

Which Were the Top-Performing Stocks?

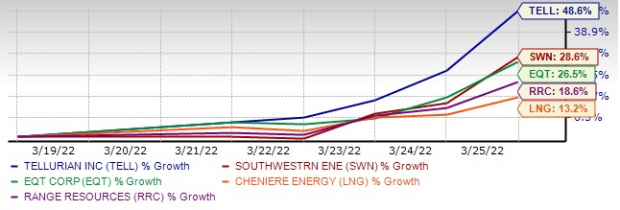

Image Source: Zacks Investment Research

Tellurian

led the gainers, with the Zacks Rank #3 (Hold) stock surging 48.6% last week. An LNG developer headquartered in Houston, TX, TELL racked up a 20%+ gain on Friday to set a new 52-week high following the supply deal between the United States and the EU.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Tellurian is valued at around $3 billion and has a projected earnings growth rate of 17.9% for this year. TELL is trying to get its Driftwood LNG project off the ground and so the agreement was a particularly encouraging development for the company.

Southwestern Energy

got in on the action, too, with gains of 28.6%. The advance allowed the stock to score a new 52-week high of $6.95 on Mar 25. Southwestern Energy churns out in excess of 1 trillion cubic feet equivalent of hydrocarbons annually, 80% of which is natural gas.

Southwestern Energy beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters, the average being 3.2%. SWN is valued at around $7.7 billion and has a projected earnings growth rate of 31.4% for this year.

Late gains in the week also propelled

EQT Corp.

26.5% higher, reaching a 52-week high of $34.47. EQT is primarily an explorer and producer of natural gas, with a primary focus on the Appalachian Basin in Ohio, Pennsylvania and West Virginia. In terms of average daily sales volumes, EQT Corp is the largest natural gas producer in the domestic market.

EQT Corp. has a projected earnings growth rate of 126.1% for this year. The Zacks Consensus Estimate for EQT’s 2022 earnings has been revised 10.6% upward over the past 30 days.

Range Resources

scored a new 52-week high in Friday’s trading to round out a weekly rise of 18.6%. Range Resources has a strong footing in the prolific Appalachian Basin. In the gas-rich resource, the upstream firm has huge inventories of low-risk drilling sites that are likely to provide production for several decades.

Range Resources has a projected earnings growth rate of 83.7% for this year. The Zacks Consensus Estimate for RRC’s 2022 earnings has been revised 3.1% upward over the past 30 days.

Cheniere Energy

is another stock to move up nicely in the week (+13.2%) and hit a new 52-week high. With the dramatic growth of natural gas exports and being the first company to receive regulatory approval to ship LNG from its Sabine Pass terminal, Cheniere Energy certainly enjoys a distinct competitive advantage.

The company is valued at around $38 billion and has a projected earnings growth rate of 218.2% for this year. The Zacks Consensus Estimate for Cheniere Energy’s 2022 earnings has been revised 15.3% upward over the past 30 days.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report