Vancouver, British Columbia–(Newsfile Corp. – August 31, 2021) – Next Green Wave Holdings Inc. (CSE: NGW) (OTCQX: NXGWF) (“Next Green Wave”, “NGW” or the “Company”), a premium seed-to-shelf craft cannabis producer, is pleased to announce the following operational and financial updates:

Construction Update

The Company has been awarded its building permit by the City of Coalinga. In addition, NGW is pleased to announce it has completed the Civil Work (previously announced HERE).

The construction timeline for its 62,000 premium indoor cultivation facility (“Facility B”) is currently as follows:

- Civil Work completed in August 2021

- Building permit obtained in August 2021

- Certificate of Occupancy obtained in Q4 2022

While construction at Facility B (the “Project”) has progressed well, the Project is currently facing a three to six month delay due to disruptions in the supply chain, mainly regarding steel, which has negatively impacted availability and pricing of essential construction materials.

Shareholder Call

The Company is also pleased to announce the details of its quarterly shareholder call scheduled to take place on Thursday Sep 2, 2021 at 3:30PM PST. Pre-registration is mandatory and can be completed by clicking HERE. After registration, you will receive a confirmation email containing information on how to join the call.

AGM Announcement

The Company’s 2021 annual general meeting (AGM) will take place on November 5, 2021 at 2:30PM PST.

The Company expects to publish its information circular to shareholders in October 2021 and intends to file its definitive proxy statement, which includes the meeting proposals for its 2021 AGM, on SEDAR in October 2021.

Financial Updates

The Company has released its financial statements for the three and six-month periods ended June 30, 2021, which can now be found on SEDAR.

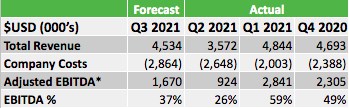

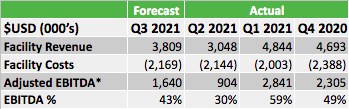

In the below table, the Company has provided a forecast of Q3 2021 (“the Forecast”) of its expected Revenue and Adjusted EBITDA*. In addition, the Company is pleased to announce a new type of revenue (“Distro Revenue”), which involves buying and selling third party flower. As the margins on Distribution Revenue are lower than Facility Revenue, the Company has chosen to provide separately, revenue and cost of sales relating to both activities.

The three tables below break out the following by quarter:

- Total (Facility + Distro) Revenue, Costs and Adjusted EBITDA*

- Facility Revenue, Costs and Adjusted EBITDA*

- Distro Revenue, Costs and Adjusted EBITDA*

Table 1

To view an enhanced version of table 1, please visit:

https://orders.newsfilecorp.com/files/6127/94989_79851b19c473289a_002full.jpg

Table 2

To view an enhanced version of Table 2, please visit:

https://orders.newsfilecorp.com/files/6127/94989_79851b19c473289a_003full.jpg

Table 3

To view an enhanced version of Table 3, please visit:

https://orders.newsfilecorp.com/files/6127/94989_79851b19c473289a_004full.jpg

Q2 2021 revenues decreased mainly due to the following non-recurring items:

-

significant shifts in the market for derivatives, at both the retail and wholesale level, the Company adjusted it’s branded product mix deemphasizing edibles, pre rolls and dabbables which resulted in lower overall sales for the quarter.

-

a hardware update for the NGW branded sauce carts, cart sales lagged in Q2 2021 resulting in lower overall sales for the quarter. With R&D successfully completed, the Company anticipates relaunching NGW’s 2.0 sauce cart in September and expects to see growing sales month over month until meeting internal production capacity in early 2022.

“Due to the necessary adjustments made to our branded product menu, we have seen a strong rebound to both the top and bottom line in Q3 2021. By increasing per plant yields, reducing turnaround time between cycles, improving operational efficiencies and continually adding better performing genetics through our pheno hunts we have made up significant ground replacing any lost derivative revenue in less than one fiscal quarter.

“As such, we are very excited about the testing results coming out of our Facility right now, and when combined with the increasing quarter over quarter yield, I am very excited about the revenue and brand growth potential this brings to Next Green Wave in the short and long term. We currently have six unique strains testing consistently above 30% THC and we anticipate our entire menu consisting of strains above 30% THC in early 2022.

“Additionally, we are actively pursuing the acquisition of retail locations in key markets throughout the state to fulfill NGW’s mission of becoming a top 5 integrated premium producer, brand and retailer in the California market. This is just the beginning!”

Michael Jennings

Chief Executive Officer, Director

Next Green Wave Holdings Inc.

About Next Green Wave

Next Green Wave is an integrated premium seed-to-shelf craft cannabis producer offering products through its in-house brand portfolio and wholesale flower for other large cannabis manufacturers. The Company owns and operates a 35,000 sq. ft. indoor facility in Coalinga, CA, which is home to our nursery, cultivation, distribution, and future packaging business. Marketing, product design, and formulation are produced in-house; please follow along at www.nextgreenwave.com or on Twitter, Instagram, or LinkedIn.

For more information regarding Next Green Wave, please contact:

Matthew Jewell

CFO

Tel: +1 (604) 684-6844

IR@nextgreenwave.com

Neither Canadian Securities Exchange (the “CSE”) nor its Regulation Services Providers (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

*All financial information is provided in U.S. dollars and is unaudited and is subject to change. Any preliminary unaudited long-term financial projections provided herein have not been prepared in accordance with IFRS. Management uses non-IFRS financial measures, in addition to IFRS financial measures, to understand and compare operating results across accounting periods, for financial and operational decision making, for planning and forecasting purposes and to evaluate the Company’s financial performance. One example of a non-IFRS financial measure is Adjusted EBITDA, which has limitations as an analytical tool as it excludes from net income as reported, interest, tax, depreciation, other income and expenses, non-cash grow costs expensed for biological assets and unsold inventory, and the non-cash fair value effects of accounting for biological assets and inventories. Management believes that these non-IFRS financial measures reflect the Company’s ongoing business in a manner that allows for meaningful comparisons and analysis of trends in the business, as they facilitate comparing financial results across accounting periods and to those of peer companies. Management also believes that these non-IFRS financial measures enable investors to evaluate the Company’s operating results and future prospects in the same manner as management. These non-IFRS financial measures may also exclude expenses and gains that may be unusual in nature, non-cash, infrequent or not reflective of the Company’s ongoing operating results. As there are no standardized methods of calculating these non-IFRS measures, the Company’s methods may differ from those used by others, and accordingly, the use of these measures may not be directly comparable to similarly titled measures used by others. Accordingly, Non-IFRS financial measures should not be considered superior to, as a substitute for or as an alternative to, and should only be considered in conjunction with IFRS financial Measures.

Next Green Wave Forward Looking Statements

This press release contains forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, are “forward-looking statements” and such forward-looking statements and forward-looking information represent only NGW’s beliefs regarding future events, plans or objectives, many of which, by their nature, are inherently uncertain and outside of NGW’s control. Generally, such forward-looking information or forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts” “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or may contain statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “will continue”, “will occur” or “will be achieved”. The forward-looking information and forward-looking statements contained herein may include, but are not limited to, the Company’s expectations for long-term (YE 2021, YE 2022 and YE 2023) revenue and adjusted EBITDA profitability, the ability of the Company to successfully achieve business objectives (including completion of construction and increasing production capacity), and expectations for other economic, business, and/or competitive factors. There can be no assurance that such forward-looking information will prove to be accurate, and actual results and future events could differ materially from those anticipated in such forward-looking information. This forward-looking information reflects NGW’s current beliefs and is based on information currently available to NGW and on assumptions NGW believes are reasonable.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be materially different from any future results, events or developments expressed or implied by such forward looking information. Such risks, uncertainties and other factors include, among others: dependence on obtaining and maintaining regulatory approvals, including acquiring and renewing state, local or other licenses and any inability to obtain all necessary governmental approvals licenses and permits to complete construction of its proposed facilities in a timely manner; engaging in activities which currently are illegal under US federal law and the uncertainty of existing protection from U.S. federal or other prosecution; regulatory or political change such as changes in applicable laws and regulations, including U.S. state-law legalization, particularly in California, due to inconsistent public opinion, perception of the medical-use and adult-use marijuana industry, bureaucratic delays or inefficiencies or any other reasons; any other factors or developments which may hinder market growth; NGW’s limited operating history and lack of historical profits; reliance on management; NGW’s requirements for additional financing, and the effect of capital market conditions and other factors on capital availability, competition, including from more established or better financed competitors; the need to secure and maintain corporate alliances and partnerships, including with customers and suppliers; and risks and delays resulting from the COVID-19 pandemic. These factors should be considered carefully, and readers are cautioned not to place undue reliance on such forward-looking statements. Although NGW has attempted to identify important risk factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other risk factors that cause actions, events or results to differ from those anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in forward-looking statements. NGW has no obligation to update any forward-looking statement, even if new information becomes available as a result of future events, new information or for any other reason except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/94989