Novartis AG

NVS

announced data from the pivotal phase III PSMAfore study, which evaluated its cancer drug Pluvicto for treating patients with PSMA–positive metastatic castration-resistant prostate cancer (mCRPC) following treatment with androgen-receptor pathway inhibitor (ARPI) therapy.

Data from the study showed that treatment with Pluvicto led to a statistically significant and clinically meaningful improvement in radiographic progression-free survival (rPFS), the study’s primary endpoint, in the above-mentioned patient group, versus a change in ARPI.

With the above-mentioned data, Pluvicto has now become the first PSMA-targeted radioligand therapy to demonstrate clinical benefit in mCRPC patients before receiving taxane-based chemotherapy.

This is the second phase III study on Pluvicto, which has met the primary endpoint. Earlier, the phase III VISION study showed that patients with PSMA–positive mCRPC, who received Pluvicto plus standard of care after being treated with other anticancer treatments like ARPI and taxane-based chemotherapy, experienced a statistically significant reduction in risk of death.

NVS plans to submit the findings from the PSMAfore study at an upcoming medical conference and file for label expansion approval for Pluvicto to regulatory authorities in 2023.

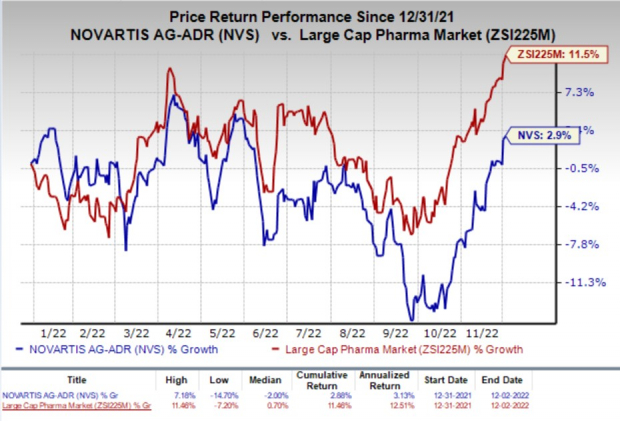

Shares of Novartis have inched up 2.9% so far this year compared with the

industry

’s increase of 11.5%.

Image Source: Zacks Investment Research

At present, Pluvicto is approved to treat patients with PSMA–positive mCRPC who have been treated with ARPI and taxane-based chemotherapy in the United States and some other countries based on data from the VISION study. It was approved in the United States in March and is also approved in the U.K. and Canada,

In October 2022, the Committee for Medicinal Products for Human Use (“CHMP”) of the European Medicines Agency adopted a positive opinion of Pluvicto. The CHMP recommended granting marketing authorization to Pluvicto in combination with androgen deprivation therapy with or without androgen receptor (AR) pathway inhibition for the treatment of adult patients with progressive PSMA-positive mCRPC who have been treated with AR pathway inhibition and taxane-based chemotherapy.

A final decision from the European Commission is expected shortly.

Pluvicto is also being evaluated in additional phase III studies in earlier lines of treatment for metastatic prostate cancer. Approval for an additional patient population is likely to boost the growth potential of the drug, which has already witnessed an encouraging uptake so far.

Zacks Rank & Stocks to Consider

Novartis currently carries a Zacks Rank #4 (Sell). Some better-ranked stocks in the biotech sector are

ASLAN Pharmaceuticals Limited

ASLN

,

Aeglea BioTherapeutics, Inc.

AGLE

and

Immunocore Holdings plc

IMCR

, all carrying a Zacks Rank #2 (Buy) at present.You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Loss per share estimates for ASLAN Pharmaceuticals have narrowed 6.1% for 2022 and 5.7% for 2023 in the past 60 days.

Earnings of ASLAN Pharmaceuticals surpassed estimates in two of the trailing four quarters and missed on the remaining two occasions. ASLN witnessed an earnings surprise of 1.64% on average.

Loss per share estimates for Aeglea BioTherapeutics have narrowed 7.3% for 2022 and 13.2% for 2023 in the past 60 days.

Earnings of Aeglea BioTherapeutics surpassed estimates in two of the trailing four quarters and missed on the remaining two occasions. AGLE witnessed an earnings surprise of 3.60% on average.

Loss per share estimates for Immunocore have narrowed 39.7% for 2022 and 39.4% for 2023 in the past 60 days.

Earnings of Immunocore surpassed estimates in three of the trailing four quarters and missed on the remaining occasion. IMCR witnessed an earnings surprise of 68.34% on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report