Oncology stocks are currently gaining a lot of attention in the investment world. Over the past few years, there has been a considerable rise in the reported cases of cancer, thus driving the oncology market. Cancer is currently the sixth leading cause of global deaths, per WHO estimates.

Presently, the most effective cancer treatments are based on biological drugs, also known as biologics, and include targeted therapies as well as immunotherapies. These drugs are very highly priced because of their complex manufacturing processes and long development time. These huge expenditures and the spur in cancer incidents have led to the emergence of various treatment procedures, including the development of biosimilars. Cell and gene therapy is another emerging treatment option.

With oncology gaining prominence, the broader MedTech sector has become a safe haven for investors to park their funds with those players who are currently engaged in cancer treatments. With a potential upside on this front, investors can safely place their bets on such players to reap long-term returns.

Let us delve deeper.

Oncology Gaining Traction

Cancer treatment involves heavy expenditure, thus putting pressure on the financial health of patients. To lower the cost, the development of biosimilars of branded oncology biologics has been on the rise of late. These biosimilars, which are very similar to the reference biologics in terms of effectiveness and safety, can significantly reduce the expenditure on cancer treatment due to their lower costs.

Per a report by the Business Research Company

, the global oncology biosimilars market is expected to rise from $2.88 billion in 2020 to $3.1 billion in 2021, at a CAGR of 7.6%.

Another side of oncology is the cell and gene therapy to treat cancer. Cell and gene therapy are overlapping fields of biomedical research, which has similar therapeutic goals, including use in oncology. Gene therapy uses genetic material, or DNA, to manipulate a patient’s cells for the treatment of an inherited or acquired disease. Cell therapy is the introduction of new cells into a patient’s body to grow, replace or repair damaged tissue to treat a disease.

The Business Research Company

anticipates the market to rise from a worth $6.69 billion in 2020 to $7.96 billion in 2021, at a CAGR of 19%.

Realizing the potential in the development of various cancer treatment options, a number of oncology players are coming to the forefront. A notable player in the cancer treatment via the development of biosimilars is

Novartis AG

NVS

. The company’s generic pharmaceuticals and biosimilars global operating division, Sandoz, announced the launch of generic oncology treatment Pemetrexed in 11 countries across Europe, including Germany, Switzerland, Netherlands, and Spain in June.

5 Oncology Stocks to Focus on

Here we have picked five oncology stocks from the MedTech space which have been quite active on this front and performed impressively in recent times.

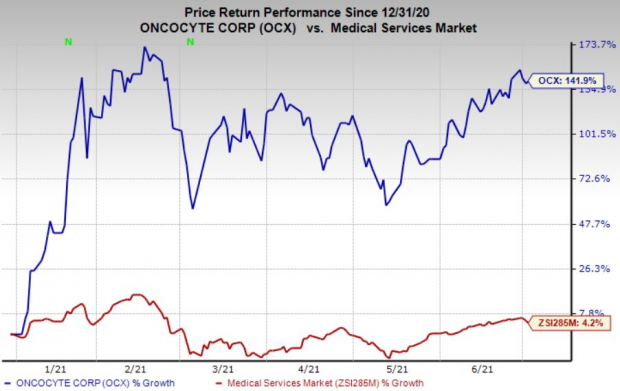

The first stock that investors can focus on is well-known molecular diagnostics company,

OncoCyte Corporation

OCX

. This Zacks Rank #3 (Hold) company announced a strategic collaboration with Gruppo Oncologico del Nord-Ovest. This partnership is aimed at evaluating Oncocyte’s proprietary gene expression test — DetermaIO — as a biomarker for immunotherapy response in metastatic colorectal cancer. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Its expected earnings growth rate for 2022 is pegged at 11.1%. Year to date, the stock has gained 141.8% compared with the

industry

’s 4.1% rise.

Renowned provider of products, services and solutions for the diagnostics, life sciences and applied markets,

PerkinElmer, Inc.

PKI

, is the next stock on the list. This Zacks Rank #3 company inked a deal in June to acquire SIRION Biotech GmbH, which is expected to close during the third quarter of 2021. The latest buyout is likely to be an important addition to the company’s growing cell and gene therapy research and development activities.

Image Source: Zacks Investment Research

Its long-term expected earnings growth rate is pegged at 37.9%. Over the past year, the stock has gained 57.9% compared with the

sector

’s 48.5% rise.

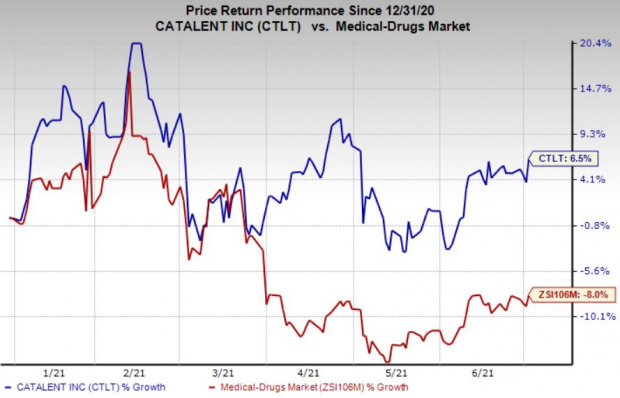

Catalent, Inc.

CTLT

, well-known global provider of advanced delivery technologies, is the next stock in focus. The Zacks Rank #3 company reached an agreement in June to acquire RheinCell Therapeutics GmbH, which is expected to close before the end of 2021, subject to customary conditions. The buyout will enable Catalent to offer the building blocks to scale induced pluripotent stem cells-based cell therapies as well as reduce entry barriers to the clinic for therapeutic companies.

Image Source: Zacks Investment Research

Its long-term expected earnings growth rate is pegged at 20.9%. Year to date, the stock has gained 6.5% against the

industry

’s 8% fall.

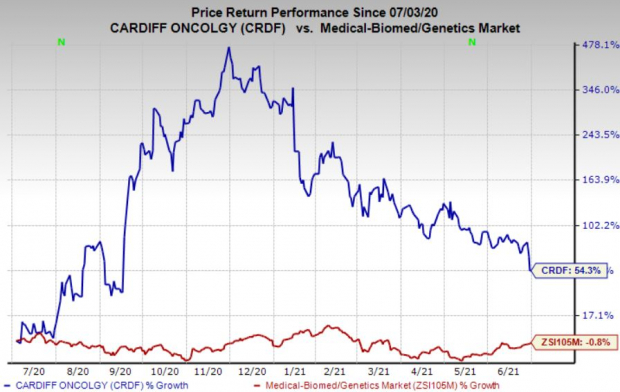

Next up is clinical-stage biotechnology company,

Cardiff Oncology, Inc.

CRDF

. The Zacks Rank #3 company announced in June that the first patient has been dosed in its Phase 2 clinical trial of onvansertib in combination with nanoliposomal irinotecan and 5-FU as a second-line treatment for metastatic pancreatic ductal adenocarcinoma.

Image Source: Zacks Investment Research

Its expected earnings growth rate for 2021 is pegged at 41.7%. Over the past year, the stock has gained 54.3% against the

industry

’s 0.8% fall.

NovoCure Limited

NVCR

, a global oncology company with a proprietary platform technology called Tumor Treating Fields (TTFields), is the final name on the list. The Zacks Rank #3 company, in July, announced final results from its phase 2 pilot HEPANOVA trial in liver cancer. The test assessed the safety and efficacy of TTFields together with sorafenib for the treatment of advanced hepatocellular cancer.

Image Source: Zacks Investment Research

Its expected earnings growth rate for 2022 is pegged at 425%. Year to date, the stock has gained 9.6% compared with the industry’s 4.1% rise.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report