Shares of

PDS Biotechnology Corporation

PDSB

were up 23.8% on Dec 28 after management announced interim data from a phase II study, which evaluated a PDS0101-based triple combination therapy in checkpoint inhibitor (CPI)-naïve and CPI-refractory patients with advanced human papillomavirus (HPV)-positive cancers.

The PDS0101-based triple combination therapy consisted of PDS Biotech’s lead pipeline candidate PDS0101, tumor-targeting IL-12 fusion protein M9241 and a bifunctional fusion protein targeting two independent immunosuppressive pathways (PD-L1 and TGF-β), bintrafusp alfa.

Data from the study achieved a median overall survival (OS) of 21 months in 29 checkpoint inhibitor (CPI) refractory HPV16-positive cancer patients who received the triple combination therapy. Per management, the historical median OS in patients with CPI refractory disease is 3-4 months. In CPI-naïve patients, the median OS is yet to be reached as 75% of patients remain alive at a median follow-up of 27 months.

While the objective response rate (ORR) in CPI-refractory patients administered an optimal dose of the triple dose combination was 63%, the ORR in CPI-naïve patients was 88%. Per management, the current approaches have achieved ORRs of less than 10% and 25% in CPI-refractory and CPI- naïve patients, respectively.

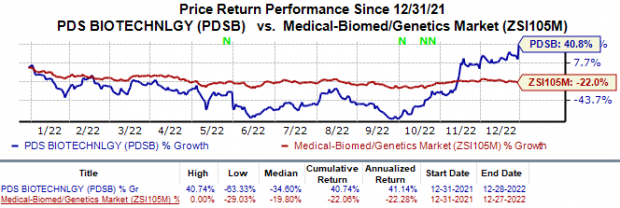

Shares of PDS Biotech have lost 40.7% in the year against the

industry

’s 22.1% decline.

Image Source: Zacks Investment Research

Based on the above data, PDS Biotech intends to discuss its next steps and plans for a registrational study evaluating this PDS0101-based triple combination therapy.

All patients enrolled in this phase II study had failed prior treatment with chemotherapy and 90% had failed radiation treatment. We note that the study is being conducted by the National Cancer Institute (NCI), one of the Institutes of the National Institutes of Health (NIH).

Zacks Rank & Stocks to Consider

PDS Biotech currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include

Acer Therapeutics

ACER

,

Amylyx Pharmaceuticals

AMLX

and

Can-Fite BioPharma

CANF

. While Acer Therapeutics sports a Zacks Rank #1 (Strong Buy), Amylyx Pharmaceuticals and Can-Fite BioPharma carry a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

In the past 60 days, estimates for Acer Therapeutics’ 2022 loss per share have narrowed from $2.47 to $1.50. During the same period, the loss estimates per share for 2023 have narrowed from $1.07 to 61 cents. Shares of Acer Therapeutics have risen 12.7% year-to-date.

Earnings of Acer Therapeutics beat estimates in two of the last four quarters and missed the mark twice, witnessing a negative earnings surprise of 95.82%, on average. In the last reported quarterAcer Therapeutics’ earnings beat estimates by 59.21%.

In the past 60 days, estimates for Amylyx Pharmaceuticals’ 2022 loss per share have narrowed from $3.54 to $3.53. During the same period, the loss estimates per share for 2023 have narrowed from 65 cents to 60 cents. Shares of Amylyx Pharmaceuticals have surged 93.4% in the year-to-date period.

Earnings of Amylyx Pharmaceuticals missed estimates in two of the last three quarters and beat the mark once, witnessing a negative earnings surprise of 6.65%, on average. In the last reported quarter, Amylyx Pharmaceuticals’ earnings beat estimates by 5.15%.

In the past 60 days, estimates for Can-Fite BioPharma’s 2022 loss per share have narrowed from 37 cents to 28 cents. During the same period, the loss estimates per share for 2023 have narrowed from 17 cents to 12 cents. Shares of Can-Fite BioPharma have declined 49.7% in the year-to-date period.

Earnings of Can-Fite BioPharma beat estimates in three of the last four quarters and missed the mark once, witnessing a earnings surprise of 10.14%, on average. In the last reported quarter, Can-Fite BioPharma’s earnings beat estimates by 10.00%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report