Pfizer

PFE

has finally unveiled Priovant Therapeutics, a company formed in collaboration with

Roivant Sciences

ROIV

last September to develop and market novel therapies for autoimmune diseases. Pfizer holds a 25% equity ownership stake in Priovant.

As part of the collaboration with Roivant Sciences in September, Pfizer out-licensed global development rights for an oral and topical formulation of brepocitinib, apotential first-in-class dual inhibitor of TYK2 and JAK1 to Priovant. PFE has out-licensed the commercial rights for brepocitinib in the United States and Japan to Priovant. PFE will retain ex-U.S. commercial rights for the drug.

Pfizer has also licensed similar rights to a selective TYK2 inhibitor, ropsacitinib, to Priovant.

Although Pfizer had mentioned the licensing deal and the formation of the new company on the third-quarter 2021 conference call last November, it did not disclose the name or details of Roivant Sciences or Priovant Therapeutics at the time.

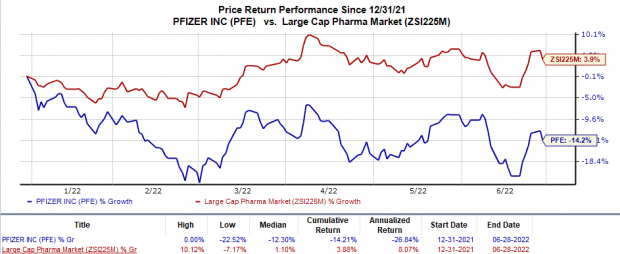

Shares of Pfizer have lost 14.2% in the year so far against the

industry

’s 3.9% rise.

Image Source: Zacks Investment Research

Priovant Therapeutics is developing the oral formulation of brepocitinib as a franchise for multiple orphan and specialty autoimmune disease, which not only has high morbidity and mortality but also does not have many safe and effective treatment options. A dual inhibition of TYK2 and JAK1 is expected to provide greater efficacy than inhibiting either one alone.

An oral formulation of brepocitinibis currently being evaluated in registration-enabling clinical studies in two indications. A recently initiated phase III VALOR study, which is currently enrolling participants, is evaluating the drug as a potential treatment for dermatomyositis. A phase IIb study is evaluating oral brepocitinib in systemic lupus erythematosus (“SLE”). Data from this study is expected in second-half 2023.

The oral formulation of brepocitinib has been evaluated in 14 completed early-stage and mid-stage studies. These include five phase II studies wherein treatment with the drug in psoriatic arthritis, plaque psoriasis, ulcerative colitis, alopecia areata and hidradenitis suppurativa indications generated statistically significant and clinically meaningful results compared to those who were administered a placebo. The safety profile of the drug was also consistent with that of an approved JAK inhibitor.

Per Pfizer, Roivant’s expertise in late-stage inflammation and immunology drug development will be beneficial to this partnership. PFE also expects the collaboration with ROIV to allow it to focus on diversifying its pipeline against inflammatory diseases.

Zacks Rank & Stocks to Consider

Pfizer currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include

Abeona Therapeutics

ABEO

and

Sesen Bio

SESN

. While Sesen Bio sports a Zacks Rank #1 (Strong Buy) at present, Abeona Therapeutics carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Estimates for Sesen Bio’s 2022 bottom line have declined from a loss of 46 cents to 44 cents in the past 60 days. Share prices of Sesen Bio have risen 0.5% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 69.9%. In the last reported quarter, Sesen Bio delivered an earnings surprise of 100%.

Estimates for Abeona Therapeutics’ 2022 bottom line have narrowed from a loss of 33 cents to 31 cents in the past 60 days. Shares of Abeona Therapeutics have plunged 45.3% in the year-to-date period.

Earnings of Abeona Therapeutics missed estimates in two of the trailing four quarters and matched the same twice, with the average negative surprise being 8.2%. In the last reported quarter, Abeona Therapeutics missed earnings estimates by 25%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report