Shares of

Praxis Precision Medicines, Inc.

PRAX

were down 78.1% on Monday after the company announced disappointing data from the phase II/III Aria study that evaluated its pipeline candidate, PRAX-114, for monotherapy treatment of major depressive disorder (“MDD”).

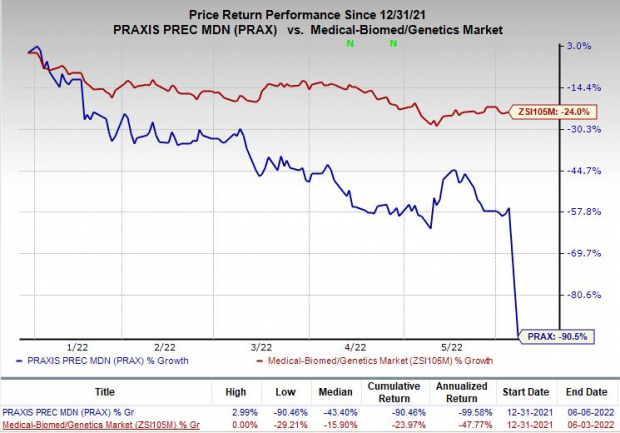

Praxis’ stock has plunged 90.5% so far this year compared with the

industry

’s decline of 24%.

Image Source: Zacks Investment Research

The Aria study investigated the safety and efficacy of PRAX-114 as a monotherapy for treating MDD. The study did not achieve statistical significance on the primary endpoint of change from baseline in the 17-item Hamilton Depression Rating Scale’s total score at day 15.

PRAX-114 was, however, well-tolerated in the Aria study.

Along with the latest press release, Praxis announced that it has decided to make a strategic realignment to reduce its workforce and lower future operating expenses.

As a part of this realignment, Praxis expects that its cash runway will now extend into 2024. The company remains focused on delivering phase IIb data on another pipeline candidate, PRAX-944, in essential tremor (Essential1 Study) as well as on proof of concept for PRAX-562 in epilepsy, besides advancing its pre-clinical pipeline.

In the absence of a marketed product, successful development of pipeline candidates remains in key focus for Praxis.

PRAX-114 is also being evaluated in the dose-ranging phase II Acapella study for the treatment of MDD. Top-line data from the same is expected in the third quarter of 2022.

A placebo-controlled phase II study is evaluating PRAX-114 for treatment of post-traumatic stress disorder or PTSD. Top-line data from the same is expected in the second half of 2022.

Meanwhile, in the first quarter of 2022, Praxis initiated a phase II crossover study evaluating PRAX-114 (10 and 20 mg) for daytime treatment of essential tremor. Top-line data from the same is also expected in the second half of 2022.

Zacks Rank & Stocks to Consider

Praxis currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector are

Leap Therapeutics, Inc.

LPTX

,

Anavex Life Sciences Corp.

AVXL

and

Precision BioSciences, Inc.

DTIL

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Leap Therapeutics’ loss per share has narrowed 11.1% for 2022 and 5.9% for 2023 in the past 60 days.

Earnings of Leap Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion. LPTX delivered an earnings surprise of 1.92%, on average.

Anavex Life Sciences’ loss per share estimates narrowed 6.6% for 2022 and 4.3% for 2023 in the past 60 days.

Earnings of Anavex Life Sciences have surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions. AVXL delivered an earnings surprise of 0.48%, on average.

Precision BioSciences’ loss per share estimates narrowed 21.7% for 2022 and 31.4% for 2023 in the past 60 days.

Earnings of Precision BioSciences have surpassed estimates in each of the trailing four quarters. DTIL delivered an earnings surprise of 76.15%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report