Shares of

Reata Pharmaceuticals, Inc.

RETA

gained 8.7% on Apr 1 after the company completed the rolling submission of a new drug application (“NDA”) for its lead pipeline candidate, omaveloxolone. The NDA is seeking approval for the candidate as a treatment for patients with Friedreich’s ataxia, an inherited disorder that affects some of the body’s nerves.

The candidate will become the first FDA-approved therapy for the rare, genetic neuromuscular disorder Friedreich’s ataxia following a potential approval.

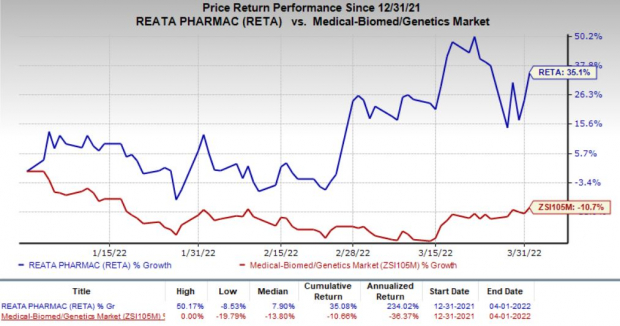

In fact, Reata’s shares have gained 35.1% so far this year against the

industry

’s decrease of 10.7%.

Image Source: Zacks Investment Research

Please note that omaveloxolone enjoys Fast Track and Orphan Drug designations for treating Friedreich’s ataxia. The Fast Track status will likely accelerate the review of the NDA while the Orphan Drug status will likely provide extended exclusivity for the drug.

The NDA for omaveloxolone was supported by data from a two-part pivotal study, MOXIe, as well as MOXIe Extension studies.

Reata successfully completed the pivotal MOXIe study on its omaveloxolone as a potential treatment for FA in 2019. The data showed a statistically significant improvement in mFARS (a measure of FA disease progression) compared to placebo after 48 weeks of treatment. The company also successfully completed a baseline-controlled study (crossover study) and exploratory analyses for additional data requested by the FDA previously.

In October last year, Reata completed its pre-NDA meeting with the FDA for omaveloxolone NDA. The company is seeking standard approval for the candidate. However, the FDA had indicated during the pre-NDA meeting that the approval pathway can be determined only after the regulatory submission. The FDA has allowed the company to submit data from certain nonclinical and clinical studies, following a potential approval of omaveloxolone for Friedreich’s ataxia.

Reata’s investors cheered the completion of omaveloxolone NDA submission following the complete response letter (“CRL”) from the FDA for an NDA for its another lead pipeline candidate, bardoxolone, in February. The company was seeking approval for bardoxolone as a potential treatment for chronic kidney disease (“CKD”) caused by the Alport syndrome. The CRL indicated that the regulatory body could not approve the NDA in its present form. The submission of omaveloxolone NDA boosts the prospects of a commercialized product for Reata by next year.

Please note that the CRL for bardoxolone NDA was based on the negative outcome of an FDA advisory committee. The committee stated that clinical data provided with the NDA does not support the effectiveness of the candidate in slowing the progression of CKD.

Reata continues to work with the FDA to decide the next step for bardoxolone, however, it will significantly delay any potential approval to the candidate for treating CKD.

Meanwhile, Reata is also developing bardoxolone for treating autosomal dominant polycystic kidney disease (“ADPKD”) in a late-stage study. The company recently filed a protocol amendment and requested a Type A meeting with the FDA to discuss the ADPKD development program.

Zacks Rank & Stocks to Consider

Reata currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the biotech sector include

Axcella Health

AXLA

,

Trevi Therapeutics

TRVI

and

Voyager Therapeutics

VYGR

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Axcella Health’s 2022 and 2023 loss has narrowed 12.9% and 16.4%, respectively, over the past 60 days. AXLA has rallied 22.5% so far this year.

Earnings of Axcella Health have surpassed estimates in three of the trailing four quarters with earnings beat of 1.67%, on average.

The consensus estimate for Trevi’s 2022 bottom line has narrowed 19.4% for 2022 and 14.1% for 2023 over the past 60 days. TRVI stock has surged 142.9% so far this year.

Earnings of Trevi have surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions with the average beat being 5.09%.

Estimates for Voyager’s 2022 and 2023 loss have narrowed 38.6% and 29%, respectively over the past 60 days. VYGR has rallied 207.4% so far this year.

Earnings of Voyager have surpassed estimates in three of the trailing four quarters, with the average beat being 41.00%.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021

Zacks Top 10 Stocks

portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report