Regeneron Pharmaceuticals, Inc.

REGN

announced that the FDA has accepted for priority review its supplemental Biologics License Application (sBLA) seeking approval for Evkeeza (evinacumab) for use in kids.

The company is seeking label expansion for Evkeeza as an adjunct to other lipid-lowering therapies to treat children aged between five and 11 years with homozygous familial hypercholesterolemia (HoFH), an ultra-rare inherited form of high cholesterol.

With the FDA granting a priority review to the sBLA, a decision from the regulatory body is expected on Mar 30, 2023.

Evkeeza is already approved in the United States, Europe and some other countries as an adjunct therapy for certain patients aged 12 years and above with HoFH.

The sBLA was based on data from a three-part study, which evaluated Evkeeza in children aged five to 11 years with HoFH.

The study met its primary endpoint. Data from the study showed that children who added Evkeeza to other lipid-lowering therapies experienced an LDL-C reduction of 48% at week 24 on average. Notably, children already on other lipid-lowering therapies entered the study with dangerously high LDL-C (264 mg/dL on average) and 79% saw their LDL-C reduced by at least half at 24 weeks.

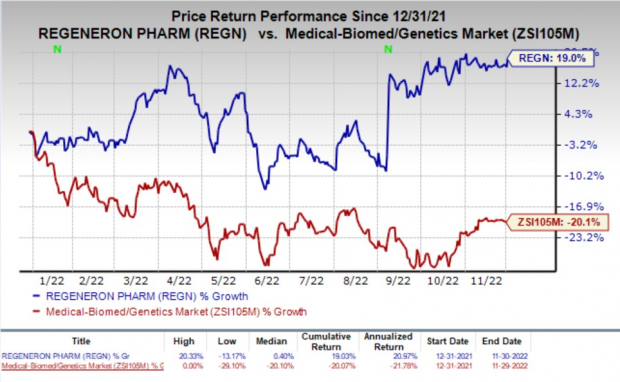

Shares of Regeneron have improved 19% so far this year against the

industry

’s decline of 20.1%.

Image Source: Zacks Investment Research

In January 2022, Regeneron entered into a collaboration agreement with

Ultragenyx

RARE

to commercialize and distribute Evkeeza outside the United States.

Regeneron is responsible for the development and distribution of Evkeeza in the United States while Ultragenyx is responsible for developing, commercializing and distributing Evkeeza outside of the United States. The regions include the European Economic Area.

Evkeeza generated sales worth $14 million in the United States in the third quarter of 2022, reflecting a significant year-over-year increase. A potential label expansion of the drug will help it to address a broader patient population and drive sales further in the days ahead.

Zacks Rank & Stocks to Consider

Regeneron currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the biotech sector are

ASLAN Pharmaceuticals Limited

ASLN

and

Immunocore Holdings plc

IMCR

, both carrying a Zacks Rank #2 (Buy) at present.You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Loss per share estimates for ASLAN Pharmaceuticals have narrowed 6.1% for 2022 and 5.7% for 2023 in the past 60 days.

Earnings of ASLAN Pharmaceuticals surpassed estimates in two of the trailing four quarters and missed on the remaining two occasions. ASLN witnessed an earnings surprise of 1.64% on average.

Loss per share estimates for Immunocore have narrowed 39.7% for 2022 and 39.4% for 2023 in the past 60 days.

Earnings of Immunocore surpassed estimates in three of the trailing four quarters and missed on the remaining occasion. IMCR witnessed an earnings surprise of 68.34% on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report