ReneSola Ltd

SOL

recently signed a share purchase agreement, involving the sell-off of its 12 Megawatt-peak portfolio of projects in Spain to Aream Group. The portfolio, known as Caravaca Project, comprises two ground-mounted solar projects located in Murcia.

Caravaca Project is co-developed by ReneSola Power and a partner who jointly owns the project through a special purpose vehicle (SPV). Through the recent agreement, Aream Group will be buying Rene Sola’s ownership in the SPV.

The sale, which is likely to be concluded in early 2022 at the ‘ready-to-build’ stage, embodies ReneSola’s most advanced project in Spain amongst its more than 300 MW pipeline of projects in the country. The deal signifies SOL’s ability to build a solar project and monetize the same and boost its operational results. The agreement strengthens ReneSola’s position in Spain.

ReneSola’s Growth Prospects in Spain

Spain’s solar market has been rapidly gaining momentum and has made considerable progress in its goal to reach carbon neutrality by 2050. Per a report from Reglobal, Spain’s solar market is the second-largest solar market in Europe, with an installed capacity of 3.8 Gigawatt (GW) in 2021, up from 3.5 GW in 2020. Looking ahead, the country will continue to align its plans to shift toward renewable sources for energy. Per the report from Mordor Intelligence, the renewable market of Spain is anticipated to see a CAGR of 6% through 2025.

Certainly, this provides immense growth opportunities for solar project developers in Spain like ReneSola to develop and sell off its solar projects.

Growth Outlook in Europe

The European Union’s new renewable goals have been boosting the emergence and growth of the solar market in the region. Per a report from Mordor Intelligence, the solar photovoltaic (PV) market in Europe is expected to see a CAGR of more than 6% in the forecast period of 2020-2025.

Considering the solid solar growth prospects in the European region, solar players who have been tapping into the European solar market are:

In October 2021,

Enphase Energy

ENPH

announced the launch of its Encharge battery storage systems in Belgium, thus expanding its footprint in the European residential solar market. Prior to this move, the company had made successful launches of IQ 7 in Belgium and Netherlands in 2020 in an effort to capitalize on the growing European solar market.

The Zacks Consensus Estimate for Enphase Energy’s sales implies a growth rate of 77.2% from the prior-year figure. ENPH’s shares have returned 8.1% in the past year.

In July 2021,

Canadian Solar

CSIQ

signed a power purchase agreement, which will enable Centrica Energy Trading to buy solar energy from two of Italy’s under-developed solar projects located in Sicily Island.

Canadian Solar’s long-term earnings growth rate is pegged at 12%. The Zacks Consensus Estimate for CSIQ’s sales indicates an improvement of 52.3% from the prior-year figure.

In September 2020,

First Solar

‘s

FSLR

advanced Series 6 PV solar modules were selected by JP Energie Environnement (JPee) to power its 59-megawatt DC Labarde solar power plant, the largest urban PV power plant in France.

First Solar’s long-term earnings growth rate is pegged at 10.8%. The Zacks Consensus Estimate for FSLR’s 2021 sales indicates an improvement of 8.1% over the prior-year figure.

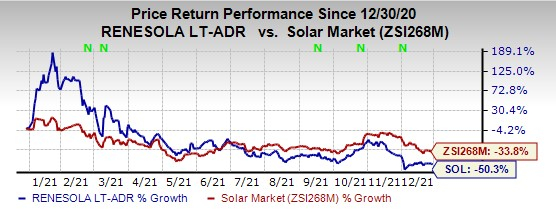

Price Movement

In the past year, shares of ReneSola have declined 50.3% compared with the

industry

’s fall of 33.8%.

Image Source: Zacks Investment Research

Zacks Rank

ReneSola currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don’t buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report