ReneSola Ltd

SOL

recently announced that it has sold its U.K.-based 24-megawatt (MW) solar-plus-storage project, Ducklington, to Innova. This, in turn, further strengthens ReneSola’s presence in Europe and provides an opportunity for the company to boost its profitability through project monetization.

The sale transaction was made at the “Ready to Build” stage. The solar farm is one among SOL’s more than 200 MW pipeline of projects in the country.

ReneSola’s Growth Prospects in the United Kingdom

ReneSola boasts a solid presence in the United Kingdom with 16 developed solar projects in its portfolio, operating 4.3 MW projects while monetizing nearly 127 MW projects. With its already established position in this region and the United Kingdom’s solid momentum, ReneSola can further augment its growth trajectory in the region going forward.

Per the report from Mordor Intelligence, the U.K. solar market is anticipated to witness a CAGR of 5% over the 2022-2027 period. Additionally, the gradual phase out of fossil fuel subsidies in the region is likely to further stimulate the growth of solar-based energy in the region.

This provides immense growth opportunities for solar project developers like ReneSola to develop and monetize the solar projects in the lucrative market of the United Kingdom, with 190 MW of projects under development in this region.

Global Solar Outlook

Nations are rapidly emerging and continuously progressing in the renewable sources of energy landscape. Therefore, the solar energy market is poised to expand considerably as it boasts the most cost-efficient pathway to attain carbon neutrality. Per a report from Mordor Intelligence, the global solar energy market is expected to witness a CAGR of more than 13.8% in the forecast 2022-2027 period.

ReneSola expects to continue with its strong pipeline growth momentum and end 2022 at 3 Gigawatt (GW) of the project pipeline and 2024 at 5 GW, which shall further boost its position in the global solar market. Meanwhile, solar players who can reap the benefits of the growing solar market trends are:

Enphase Energy

ENPH

: It enjoys a strong position in the global solar space as a leading U.S. manufacturer of microinverters and fully integrated solar-plus-storage solutions. In the fourth quarter of 2021, Enphase Energy introduced its IQ8 family of microinverters to residential installers in North America and expects to introduce the same internationally in the second half of 2022.

The Zacks Consensus Estimate for Enphase Energy’s 2022 sales implies a growth rate of 47.2% from the prior-year reported figure. ENPH shares have returned 37.8% in the past year.

Canadian Solar

CSIQ

: It has a strong pipeline of projects and carries out various acquisitions and strategies to further consolidate its position. As of Jan 31, 2022, Canadian Solar’s total project pipeline was 24.4 Gigawatt-peak(GWp), including 1.6 GWp under construction and 4.2 GWp of backlog and 18.6 GWp of earlier stage pipeline.

The Zacks Consensus Estimate for Canadian Solar’s 2022 sales indicates an improvement of 37.7% from the prior-year reported figure. CSIQ shares have returned 11.6% in the past six months.

First Solar

FSLR

developed and currently operates many of the world’s largest grid-connected photovoltaic power plants. In 2021, First Solar announced plans to expand its manufacturing capacity by 16 GW by 2023 by constructing its third manufacturing facility in the United States and its first manufacturing facility in India.

First Solar’s long-term earnings growth rate is pegged at 9.5%. Shares of FSLR have rallied 1.1% in the past year.

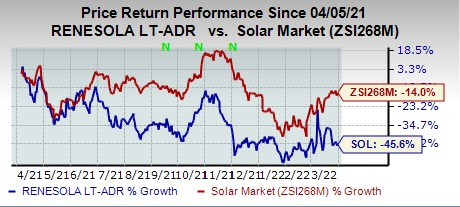

Price Movement

In the past year, shares of ReneSola have declined 45.6% compared with the

industry

’s fall of 14%.

Image Source: Zacks Investment Research

Zacks Rank

ReneSola currently carries a Zacks Rank #4 (Sell). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021

Zacks Top 10 Stocks

portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report