Rhythm Pharmaceuticals

RYTM

announced that the FDA approved its supplemental New Drug Application (sNDA), seeking the label expansion of its genetic obesity drug, Imcivree, to include patients with Bardet-Biedl syndrome (BBS), a rare genetic disease of obesity. However, the company also announced that the FDA issued a complete response letter (CRL) for another label expansion of Imcivree to include patients with Alström syndrome, an inherited disease that can cause obesity, among others.

The company is planning to reevaluate potential paths forward in Alström syndrome in the United States. It is yet to discuss the details of the CRL.

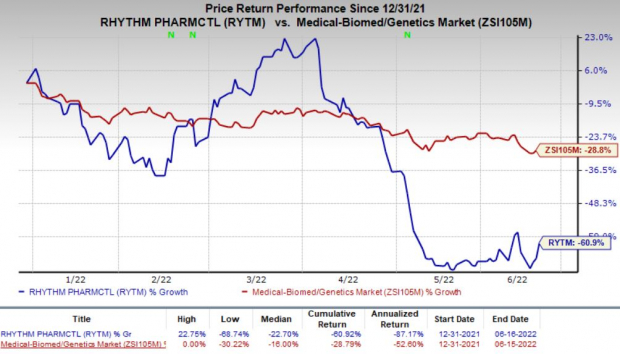

Shares of Rhythm Pharma were down almost 9% during pre-market trading on Jun 17. In fact, the company’s shares have declined 60.9% so far this year compared with the

industry

’s decrease of 28.8%.

Image Source: Zacks Investment Research

Imcivree was first approved in 2020 for chronic weight management in adult and pediatric patients 6 years of age and older with obesity due to proopiomelanocortin (POMC), proprotein convertase subtilisin/kexin type 1 (PCSK1) or leptin receptor (LEPR) deficiency confirmed by genetic testing.

Following the recent approval, the drug is now approved for chronic weight management in adult and pediatric patients 6 years of age and older with monogenic or syndromic obesity due to BBS. The drug becomes the first and only FDA-approved treatment for BBS patients with this approval. It is also the only approved drug for patients with obesity due to POMC, PCSK1 or LEPR.

The approval was based on data from a phase III study that demonstrated treatment with Imcivree, an MC4R agonist, which led to statistically significant reductions in weight and hunger in patients with BBS.

Data from the late-stage study showed that treatment of BBS patients aged above six years of age achieved a mean change in BMI of -7.9% from baseline without requirements for diet and exercise. The placebo-adjusted change in BMI was -4.5% after 14 weeks of treatment. The treatment with Imcivree also led to a statistically significant mean change in hunger score of -2.1 in patients 12 years and older who were able to self-report their hunger after one year.

In a separate press release, Rhythm Pharma announced that it has inked revenue interest financing agreement with an investment firm, HealthCare Royalty Partners, for a total investment amount of up to $100 million. Rhythm Pharma will use these funds for supporting global commercialization efforts for Imcivree and ongoing clinical development.

Per the terms of the agreement, the company will receive an initial investment amount of $37.5 million from HealthCare Royalty, following the recent approval of Imcivree for BBS patients. Another tranche of $37.5 million will be paid upon approval of the drug for BBS patients in Europe, anticipated in the second half of 2022. The final investment amount of $25 million will be payable upon Rhythm’s achievement of certain agreed sales milestones in 2023.

In exchange, HealthCare Royalty will receive a royalty on global net product sales generated by Imcivree. The total royalties to be paid by Rhythm Pharma to HealthCare Royalty is capped between 185% and 250% of the amount paid to Rhythm. The actual payment will depend on the aggregate royalty paid between 2028 and 2032.

Zacks Rank & Stocks to Consider

Rhythm Pharma currently has a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Some better-ranked biotech stocks are

Alkermes

ALKS

,

Sesen Bio

SESN

and

Anavex Life Sciences

AVXL

. While Alkermes sports a Zacks Rank #1, Sesen and Anavex carry a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Alkermes’ 2022 loss per share has narrowed from 13 cents to 3 cents in the past 60 days. Shares of ALKS have risen 16.1% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.48%.

The Zacks Consensus Estimate for Sesen Bio’s 2022 loss has narrowed from 33 cents to 32 cents per share in the past 60 days. Shares of SESN have declined 27.9% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 69.94%.

The Zacks Consensus Estimate for Anavex’s 2022 loss has narrowed from 91 cents to 85 cents per share in the past 60 days. Shares of AVXL have declined 55.4% in the year-to-date period.

Earnings of Anavex beat estimates in two of the last four quarters and missed the mark twice, the average surprise being 0.48%.

Free: Top Stocks for the $30 Trillion Metaverse Boom

The metaverse is a quantum leap for the internet as we currently know it – and it will make some investors rich. Just like the internet, the metaverse is expected to transform how we live, work and play. Zacks has put together a new special report to help readers like you target big profits.

The Metaverse – What is it? And How to Profit with These 5 Pioneering Stocks

reveals specific stocks set to skyrocket as this emerging technology develops and expands.

Download Zacks’ Metaverse Report now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report