Rhythm Pharmaceuticals

RYTM

announced that it is modifying the design of its two ongoing clinical studies that are evaluating its lead pipeline candidate setmelanotide as a precision medicine for patients with genetic diseases of obesity.

Rhythm Pharmaceuticals modified the designs of the phase III study EMANATE and the phase II study DAYBREAK to focus on rare patient populations with genetic diseases of obesity. These modifications were decided following the recent feedback from the FDA, which indicated that additional clinical studies will likely be required to support the potential registration of setmelanotide as a treatment option for non-rare patient populations.

RYTM’s decision to focus on rare patient population with genetic diseases of obesity will reduce the targeted patient population of setmelanotide, if approved, thus hurting its prospects.

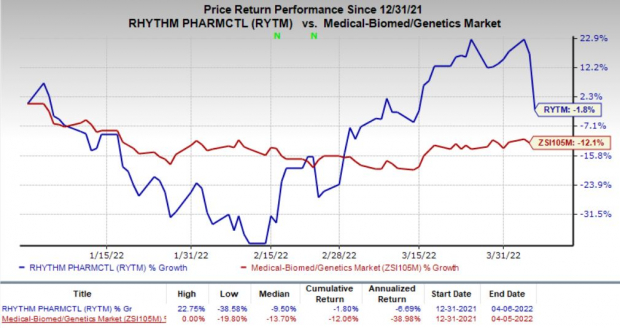

Investors were dismayed by Rhythm Pharmaceuticals’ study design modifications that induced a 16.3% decline in its share price on Apr 6. The stock has declined 1.8% so far this year compared with the

industry

’s decrease of 12.1%.

Image Source: Zacks Investment Research

Setmelanotide is a melanocortin-4 receptor (MC4R) agonist and Rhythm Pharmaceutical’s decision to focus on the pathogenic variants will most probably impair the MC4R pathway function.

The EMANATE study had five independent sub-studies evaluating setmelanotide in patients with obesity due to a heterozygous variant of the POMC/PCSK1 genes, the LEPR gene, the SRC1 gene, the SH2B1 gene and patients with a PCSK1 N221D variant. Rhythm Pharmaceuticals discontinued the study evaluating setmelanotide in patients with a PCSK1 N221D variant, which is a non-rare patient population.

Moreover, the studies evaluating the candidate in patients with variants of the POMC/PCSK1 genes and the LEPR gene will now enroll patients with suspected pathogenic variants or a subset of variants of uncertain significance (VUS), which are most likely to impair the MC4R pathway function, instead of enrolling across the entire spectrum of VUS as planned earlier.

Rhythm Pharmaceuticals believes that patients with these variant classifications have the highest probability of response to setmelanotide based on data from a previously completed mid-stage exploratory basket study.

The primary endpoint of the EMANATE study is the mean change from baseline to 52 weeks in body weight compared to placebo, measured as a percent change in the body mass index.

In the DAYBREAK study, Rhythm Pharmaceuticals decided to focus on the 10 prioritized MC4R-relevant genes with the highest probability of success. RYTM paused the enrollment of patients with variants in additional MC4R pathway genes and may include them based on early data from the study on the 10 prioritized MC4R-relevant genes.

Rhythm Pharmaceuticals expects these modifications to the EMANATE and DAYBREAK studies to result in meaningful cost savings and now expects its cash resources to fund its operations into at least the fourth quarter of 2023.

Setmelanotide was approved by the FDA in 2020 for

chronic weight management

under the brand name Imcivree.

Zacks Rank & Stocks to Consider

Rhythm Pharmaceuticals currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the biotech sector are

Axcella Health

AXLA

,

Trevi Therapeutics

TRVI

and

Voyager Therapeutics

VYGR

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Axcella Health’s 2022 and 2023 loss has narrowed 12.3% and 16.4%, respectively, over the past 60 days. AXLA has rallied 26.8% so far this year.

Earnings of Axcella Health surpassed estimates in three of the trailing four quarters and missed once, the average beat being 1.67%.

The consensus estimate for Trevi’s 2022 bottom line has narrowed 19.4% for 2022 and 14.1% for 2023 over the past 60 days. The stock has surged 142.9% so far this year.

Earnings of Trevi surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions, the average beat being 5.09%.

Estimates for Voyager’s 2022 and 2023 loss have narrowed 38.6% and 29%, respectively over the past 60 days. VYGR has rallied 227.7% so far this year.

Earnings of Voyager surpassed estimates in three of the trailing four quarters and missed once, the average beat being 41.00%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report