Roche

RHHBY

recently announced that the FDA accepted its Biologics License Application (BLA) for Lunsumio, a potential first-in-class CD20xCD3 T-cell engaging bispecific antibody.

The BLA seeks approval for Lunsumio to treat adult patients with relapsed or refractory (R/R) follicular lymphoma (FL) who have received at least two prior systemic therapies.

The regulatory body has granted Priority Review to the BLA and a decision on the same is expected by Dec 29, 2022.

The BLA is based on positive results from the phase I/II GO29781 study, wherein Lunsumio demonstrated high complete response rates, with the majority of responders maintaining responses for at least 18 months and moderate tolerability in people with heavily pre-treated FL.

After a median follow-up of 18.3 months, the median duration of responders was 22.8 months, while the complete response rate was 60% and the objective response rate was 80%.

We note that Priority Review is granted to a drug that the FDA considers potent in providing significant improvements in the effective and safe prevention, diagnosis or treatment of a severe disease.

We note that In July 2020, Lunsumio was granted Breakthrough Therapy designation (BTD) by the FDA in July 2020, for the treatment of adult patients with R/R FL who have received at least two prior systemic therapies. In June, European Commission (“EC”) granted conditional authorization for Lunsumio.

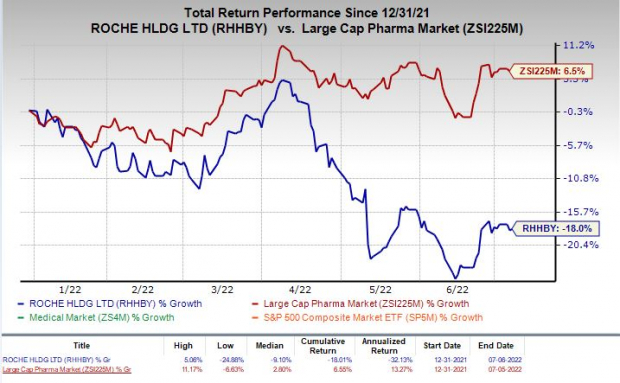

Roche’s stock has lost 18% in the year against the

industry

’s growth of 6.5%.

Image Source: Zacks Investment Research

Roche has a solid and broad oncology portfolio, and approval of additional drugs or label expansion of existing drugs will further bolster it. It has also expanded its oncology portfolio to hematology and immunology.

Roche’s hematology portfolio comprises approved drugs like MabThera, Gazyvaro (obinutuzumab), Polivy, Venclyxto (venetoclax) in collaboration with AbbVie and Hemlibra (emicizumab).

Recently Roche’s lymphoma drug Polivy (polatuzumab vedotin) in combination with MabThera (rituximab) plus cyclophosphamide, doxorubicin and prednisone (R-CHP), received EC approval for treating patients with previously untreated diffuse large B-cell lymphoma (DLBCL).

Tecentriq, the company’s leading immuno-oncology drug, is approved as a first-line treatment for adults with extensive-stage small-cell lung cancer (SCLC) in combination with carboplatin and etoposide (chemotherapy). Tecentriq also has four approved indications in advanced or metastatic NSCLC as either a single agent or in combination with targeted therapies and/or chemotherapies.

In June, the EC approved Tecentfriq as an adjuvant treatment, following complete resection and platinum-based chemotherapy, for adults with NSCLC with a high risk of recurrence whose tumors express PD-L1≥50% and who do not have EGFR mutant or ALK-positive NSCLC.

In the first quarter, Roche reported impressive performance driven by the diagnostics division, which maintained its stellar performance on demand for COVID-19 tests. The pharmaceuticals business also remained stable and newer drugs continue to offset the decline in sales of legacy drugs.

However, the outlook indicated that sales in 2022 would decline year over year due to reduced demand for its COVID-19 medicines and diagnostics.

Zacks Rank and Stock to Consider

Roche currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall health sector are

Aquestive Therapeutics

AQST

,

Aridis Pharmaceuticals

ARDS

, and

Merck & Co.

MRK

., each carrying a Zacks Rank #2 (Buy. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Aquestive Therapeutics’loss per share estimates for 2022 have narrowed from $1.50 cents to $1.34 cents in the past 30 days. The same for 2023 has narrowed from 95 cents to 74 cents in the same time frame.

Earnings of Aquestuve missed estimates in one of the trailing four quarters and beat the same on the remaining three occasions, the average surprise being 13.78%.

Aridis Pharmaceuticals’ loss per share estimates for 2022 have narrowed from $1.78 to 34 cents in the past 30 days. The same for 2023 has narrowed from 75 cents to 60 cents in the same time frame.

Earnings of Aridis missed estimates in two of the trailing four quarters and beat the same on the remaining two occasions, the average negative surprise being 75.16%.

Merck’s earnings per share estimates for 2022 have improved from $7.28 to $7.32 in the past 30 days. The same for 2023 has moved south by a penny to $7.20 in the same time frame. Shares of MRK have returned 22.9% in the year-to-date period.

Earnings of Merck missed estimates in one of the trailing four quarters and beat the same on the remaining three occasions, the average surprise being 13.42%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report