Sanofi

SNY

and partner

Regeneron

REGN

announced that the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency has rendered a positive opinion recommending the approval of Dupixent (dupilumab) for treating adults and adolescents with eosinophilic esophagitis, a chronic inflammatory disease.

A final decision from the European Commission is expected in the upcoming months. If approved in Europe, Dupixent will become the first and only targeted medicine indicated for people aged 12 years and older with eosinophilic esophagitis in the country.

Dupixent was approved by the FDA for the treatment of eosinophilic esophagitis in patients aged 12 years and above in May 2022. It is the only medicine currently approved for treating eosinophilic esophagitis in the United States.

The latest CHMP opinion considers patients aged 12 years and above, weighing at least 40 kg, whose disease is inadequately controlled by, are intolerant to or who are not candidates for conventional therapy.

The CHMP’s recommendation was based on data from a pivotal phase III study, which showed that treatment with Dupixent 300 mg weekly significantly improved patients’ ability to swallow and achieved histological disease remission compared to placebo.

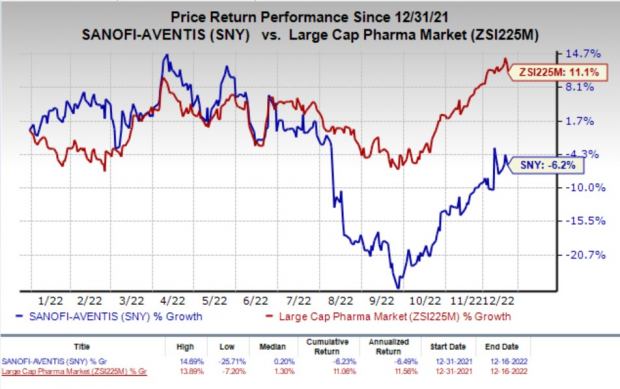

Shares of Sanofi have declined 6.2% so far this year against the

industry

’s rally of 11.1%.

Image Source: Zacks Investment Research

In Europe, Dupixent is presently approved to treat atopic dermatitis, asthma and chronic rhinosinusitis with nasal polyposis (CRSwNP). Last week, the European Commission approved Dupixent for the treatment of adult patients with moderate-to-severe prurigo nodularis.

If approved for eosinophilic esophagitis, it would be Dupixent’s fifth approved indication in Europe.

Dupixent is already approved in the United States for five indications — severe CRSwNP, severe asthma, moderate-to-severe atopic dermatitis, eosinophilic esophagitis and prurigo nodularis.

Dupixent is being jointly marketed by REGN and SNY under a global collaboration agreement. Sanofi records global net product sales of Dupixent while Regeneron records its share of profits/losses in connection with the global sales of the drug.

Dupixent’s frequent label expansion approvals are driving Sanofi’s sales. The drug generated sales worth €5.89 billion in the first nine months of 2022, reflecting an increase of 44.5% at CER year over year.

In a separate press release, Sanofi announced that it has expanded the ongoing collaboration with France-based biotech,

Innate Pharma SA

IPHA

for natural killer cell therapeutics in oncology.

Per the latest deal, SNY will gain an exclusive license to IPHA’s B7H3 ANKET program and will have options for up to two additional targets.

Sanofi and Innate signed their first NK cell engagers collaboration in 2016 for developing up to two bispecific NK cell engagers, which are currently being evaluated by Sanofi. The deal leveraged Innate Pharma’s technology with Sanofi’s bispecific antibody format as well as tumor targets.

Zacks Rank & a Stock to Consider

Sanofi currently carries a Zacks Rank #2 (Buy). Another stock to consider in the biotech sector is

ASLAN Pharmaceuticals Limited

ASLN

, also carrying a Zacks Rank #2 at present.You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Loss per share estimates for ASLAN Pharmaceuticals have narrowed 7.7% for 2022 and 7.4% for 2023 in the past 60 days.

Earnings of ASLAN Pharmaceuticals surpassed estimates in two of the trailing four quarters and missed on the remaining two occasions. ASLN witnessed an earnings surprise of 1.64% on average.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report