Schlumberger

SLB

has been awarded a significant contract by Turkish Petroleum (“TP”) to develop the Sakarya gas field off Turkey’s coast.

In 2020, TP discovered 405 billion cubic meters of natural gas in the western Black Sea region’s Sakarya field, making it the country’s biggest natural gas find. Hence, Turkey decided to operate the gas field to boost its domestic gas production.

The project will cover subsurface solutions to onshore production, which include well completions, subsea production systems; subsea umbilicals, risers, flowlines; and an early production facility (EPF).

The contract has also been awarded to

Subsea 7

SUBCY

as part of their Subsea Integration Alliance consortium. Subsea 7 will manage the subsea pipelines and associated equipment, which will connect the subsea wells in 6,560 feet of water to the EPF.

The project involves the provision and installation of infield flowlines, control umbilicals, tie-in connections, associated subsea equipment, 105 miles of the gas export pipeline, and a monoethylene glycol injection pipeline to the EPF.

Schlumberger will work on the well completions scope along with the designing, construction and commissioning of the EPF. The facility is capable of managing up to 350 MMscfd of gas. The company is ideally positioned to integrate solutions from the subsurface to the processing facility and deliver natural gas.

The companies will provide customers with a truly integrated solution for field development, and significantly contribute to the development and growth of the Turkish energy industry. The reserves will help the country bring down its reliance on energy imports and could potentially meet the country’s energy requirements for 20 years. Turkey expects the first gas from the Sakarya gas field to reach the Filyos processing terminal in 2023.

Company Profile & Price Performance

Headquartered in Houston, TX, Schlumberger is a leading oilfield service provider.

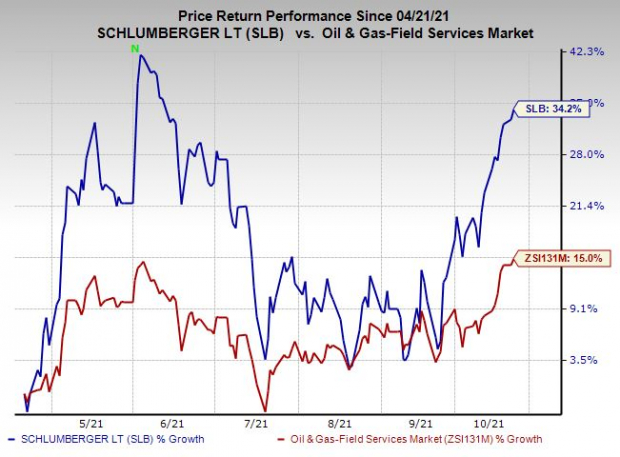

Shares of the company have outperformed the

industry

in the past six months. Its stock has gained 34.2% compared with the industry’s 15% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

The company currently carries has a Zacks Rank #2 (Buy).

Some other top-ranked players in the energy space are

Chevron Corporation

CVX

and

Earthstone Energy, Inc.

ESTE

, each currently sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Chevron’s earnings for 2021 are expected to increase 14.4% year over year.

Earthstone’s earnings for 2021 are expected to surge 92.1% year over year.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report