Click here

to read the previous silver outlook.

The

2020 silver market

was resoundingly resilient in the face of many challenges. While

COVID-19

bore down on most commodities, silver displayed its best performance in a decade.

From its lowest to highest point this year, silver climbed an impressive 137 percent; that’s compared to

gold

‘s increase of 38 percent over the same time horizon.

The white metal also reached a

seven year high

in August, trading for US$28.32 per ounce after sinking to an 11 year low of US$11.59. The comeback highlights silver’s ability to outperform gold.

Now holding in the US$23 price range, analysts and sector participants are optimistic that the

precious metal

will continue its price gain and outshine its sister metal gold.

“Once the gold rally resumes, tactical buying will help fuel further price gains for silver,” Neil Meader, director of gold and silver at Metals Focus, wrote in a recent report. “This should help silver outperform gold, which we believe will see the gold:silver ratio continue to fall during 2021.”

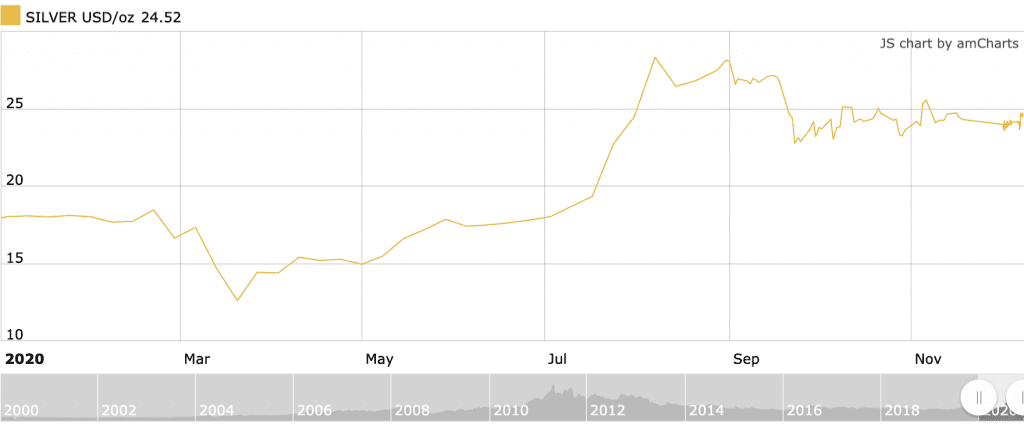

2020 silver price performance. Chart via

Kitco

.

One factor that may contribute to higher prices in 2021 is the impact of COVID-19-related closures this past year. Lockdowns in

key silver-producing countries are

likely to affect mine supply tallies from this year, which could spur price growth.

“The impact of COVID-19 on

silver supply

has been the same as for gold, only more pronounced because mined silver supply is much more concentrated in the major producing countries,” noted Adam Webb.

Webb, who is director of mine supply at Metals Focus, went on to explain that Mexico, Peru and China accounted for 52 percent of global mined silver output in 2019.

“This year mines in all three countries were temporarily suspended due to COVID-19 restrictions, with Peru in particular heavily impacted,” said Webb. “As a result, we are expecting mined silver supply to decline by 6.3 percent year-on-year, a greater drop than for gold.”

Silver outlook 2021: Physical and ETP demand to remain high

The volatility that punctuated 2020 added tailwinds to the precious metals sector, pushing both gold and silver significantly higher. Investors looked to gold and silver as safe havens and guards against inflation.

Physical silver investment is projected to reach a five year-high this year, accounting for 236.8 million ounces. The US saw the greatest increase, with investment demand climbing 62 percent.

The exchange-traded products (ETP) space is also on track to register a significant uptick.

“ETPs established a record this year, an increase of about 350 million ounces,” said Michael DiRienzo, director of the Silver Institute. “So we’ve comfortably surpassed 1 billion ounces in ETPs. I think this is a reflection of investors’ portfolio diversification, getting into hard assets like silver.”

The rise in investment purchases will help offset declines in jewelry and industrial demand, both of which were deeply impacted by COVID-19 in March and April.

“Although demand has recovered since that, most areas are still on track for heavy full year losses,” states an

interim silver market review

from the Silver Institute and Metals Focus.

The joint overview goes on to note that industrial fabrication demand is expected to fall 9 percent this year to 466 million ounces. The

photovoltaic segment

is forecasted to dip 11 percent in 2020.

“This reflects the impact of lockdown restrictions, with supply chains heavily disrupted, end-users adopting an increasingly cautious approach to inventory replenishment and factories facing labor supply problems,” reads the report.

The pervasive toll of COVID-19 will shrink global GDP by 4.4 percent; however, much of that will be reversed with rampant growth in 2021, according to

FocusEconomics

.

“Global economic growth is projected to rebound strongly in 2021, as major economies reopen and international trade picks up,” the firm states in a 2021 outlook report.

“However, the recovery is set to be uneven until a vaccine is widely available, with restrictions likely to be reimposed in response to potential further waves of the virus.”

That uncertainty will support a higher silver price, which, as Ralph Aldis of US Global Investors (NASDAQ:

GROW

) explained, also positions the white metal to continue to outpace gold.

“I do kind of expect silver to remain more volatile than gold, principally because there’s so few mines that produce silver as their primary product, and there’s just a few companies that actually focus on silver,” he explained to the Investing News Network (INN).

The price of silver has already outperformed the yellow metal in 2020, rising roughly 30 percent year-to-date compared to gold’s 17 percent. Historically, silver often doubles or triples the price action of gold.

“When you’re dealing with a real bull market in precious metals, silver’s typically at three times the price move to gold,” said Aldis. “That’s fairly common because of reduced opportunity to actually invest in silver, that just keeps it that more volatile.”

Narrow investment opportunities paired with retail and institutional investor interest are expected to sustain silver ETP and physical growth into 2021.

“The Silver Institute does) think that the future is bright for silver — not only bars and coins on the fiscal side, but also for ETP investment,” said DiRenzo.

Silver outlook 2021: Companies optimistic too

In a survey of resource-focused companies, 14 of which have honed their efforts on precious metals, INN found that broadly the companies anticipate that 2021 will be a better market for gold and silver, with 12 projecting marked improvements.

Additionally, several participants were pleasantly surprised by the price action the sister metals experienced in 2020.

The general consensus in the space is that US stimulus and lasting COVID-19 effects will play a role in the metals’ performance over the next 12 months.

Of the survey respondents, four have silver exploration projects:

Alianza Minerals

(TSXV:

ANZ

,OTC Pink:TARSF),

Sentinel Resources

(CSE:

SNL

,OTC Pink:SNLRF),

Silver Viper Minerals

(TSXV:

VIPR

,OTCQB:VIPRF) and Belcarra Group, a management firm representing three junior companies, including Silver Viper.

“I think with the stimulus packages in the US that prices are going to rise based on the US dollar being devalued,” said Stephen Cope, president and CEO of Silver Viper. “I also think that as vaccines become available and the lockdowns end investors will start to redeploy capital into the markets.”

This sentiment was echoed by Jason Weber, Alianza’s CEO, director and president. “I think that the amount of stimulus relating to the COVID-19 pandemic is only positive for gold and silver,” he said.

The full effects of COVID-19 may be delayed, as too will the benefits of a higher price point for producers. Even though silver hit a seven year high in 2020, that doesn’t make up for production disruptions.

“Higher silver prices have had little effect on production, and certainly not (enough to) offset the impact of lockdowns. Generally mines cannot be reactive to metal prices in the short term,” said Webb, who said mine plans are developed years in advance and are not easily changed.

“Certainly a small degree of flexibility is possible to target higher silver grade material or to process stockpiled material that would be uneconomic at lower prices; however, this activity is limited and will not materially impact global production in the short term.”

Silver outlook 2021: Silver price to hit US$30

For 2021, Metals Focus is forecasting added investment inflows, “driven by positive spillovers from gold and the white metal’s high beta.” The metals consultancy anticipates that silver will trade well above the US$30 level, with its annual average rising by 40 percent.

“Looking at silver’s key fundamentals, a recovery in mine production and scrap will see global supply reach a seven-year high,” reads its precious metals review. “The recovery in silver industrial application is expected to outpace global GDP growth, with offtake in 2021 almost matching the 2019 total.”

For US Global Investors’ Aldis, silver’s use in the burgeoning clean

energy

sector is exciting, especially in relation to green hydrogen, which requires massive amounts of electricity to produce.

If that electricity is to be generated cleanly, then solar will play a key role, making photovoltaics using silver important. “I think the bigger trend really is just going to be just talking about reducing global greenhouse emissions. And it’s going to have to be accomplished by more power generation using silver,” said the portfolio manager.

“That’s going to be the biggest key in terms of creating the largest scale demand for silver — you know, it’s going to be stronger than the, obviously, than the exchange-traded funds I would think.”

Watch

Steve St. Angelo of the SRSrocco Report

discuss silver’s correlation to energy challenges.

Aldis also listed some companies with a high focus on silver that investors should keep in mind. For the mid-tiers, Aldis proposed South America-focused Pan American Silver (TSX:

PAAS

,NASDAQ:PAAS).

“Pan American Silver has always had a big focus on silver,” said Aldis. “They’re about 58 percent silver in terms of their exposure.”

He also likes Coeur Mining (NYSE:

CDE

) and Wheaton Precious Metals (TSX:

WPM

,NYSE:WPM), which have 56 percent and 36 percent silver exposure, respectively.

In terms of juniors, Dolly Varden Silver (TSXV:

DV

,OTC Pink:DOLLF) offers 100 percent exposure through its exploration and development plays. Aldis also likes Africa-focused Aya Gold & Silver (TSX:

AYA

), formerly known as Maya Gold & Silver.

“You have a management team with a proven track record of running mines in West Africa, so this is one could be really interesting,” he said. “All the infrastructure is there; they just need to really get some additional capital put into it.”

Don’t forget to follow us

@INN_Resource

for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Alianza Minerals, Sentinel Resources and Silver Viper Minerals are clients of the Investing News Network. This article is not paid-for content.

The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.