STERIS

STE

has entered into an asset purchase agreement to sell the company’s Renal Care business to certain subsidiaries of

Evoqua Water Technologies Corp.

AQUA

. The transaction value has been settled at a cash consideration of $196.3 million, subject to certain potential adjustments, including a customary working capital adjustment.

STERIS aims to use the proceeds to pay down debt. Following the announcement of this news, shares of STERIS rose nearly 2% to close at $231.21 yesterday.

Spin-Off Details

This Renal Care business was originally acquired by STERIS as part of the Cantel Medical transaction, which closed on Jun 2, 2021. The business was primarily integrated into STERIS’ Healthcare segment and was historically operated by Mar Cor Purification (manufacturer and servicer of medical water, commercial and industrial solutions in North America) and Cantel Medical, subsidiaries of STERIS.

The transaction is expected to get completed in the first quarter of the calendar year 2022.

The Renal Care business currently has 27 service and regeneration facilities in the United States and Canada, and offers technical expertise in designing, building, and servicing high-purity water treatment systems to an installed base of approximately 5,500 sites.

STERIS’ Acquisition of Cantel Medical and Debt Position

In June, STERIS acquired Cantel Medical, a global provider of infection prevention products and services, primarily catering to endoscopy and dental customers. The integration has strengthened and expanded STERIS’ Endoscopy offerings, adding a full suite of high-level disinfection consumables, capital equipment and services as well as additional single-use accessories. Following the acquisition, STERIS has undertaken a number of decisions that will impact how it approaches the market with its customer-first mentality. This includes the creation of a dedicated sales channel focused solely on endoscope reprocessing in order to leverage the talent and expertise of the Cantel sales organization.

The acquisition agreement was settled at a total equity value of nearly $3.6 billion and a total enterprise value of around $4.6 billion, including Cantel Medical’s net debt and convertible notes.

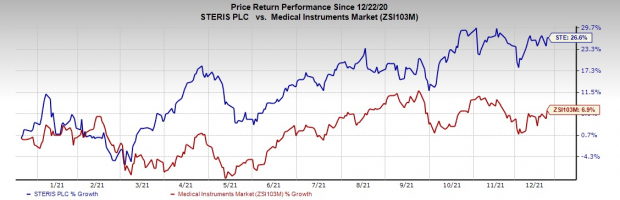

Image Source: Zacks Investment Research

For the transaction, the company had obtained fully committed bridge financing and committed to repay a significant amount of Cantel Medical’s existing debt with nearly $2.0 billion of new debt.

Following the completion of this acquisition, STERIS currently has a total debt of $3.44 billion (at the end of the second quarter of fiscal 2022). The latest spin-off of the company’s Renal Care business, which is a non-core part of STERIS business, is accordingly expected to partly reduce the company’s debt burden.

Price Performance

Shares of the company have gained 26.6% in a year’s time compared with the

industry

’s 6.9% rise.

Zacks Rank and Key Picks

Currently, STERIS carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical space are

Apollo Endosurgery, Inc.

APEN

, and

Thermo Fisher Scientific Inc.

TMO

, each carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Apollo Endosurgery has a long-term earnings growth rate of 7%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 25.6%, on average.

Apollo Endosurgery has outperformed its industry over the past year. APEN has gained 131.2% compared with 7.7% industry growth.

Thermo Fisher has a long-term earnings growth rate of 14%. The company surpassed earnings estimates in the trailing four quarters, delivering an average surprise of 9%.

Thermo Fisher has outperformed its industry over the past year. TMO has rallied 40.7% compared with the industry’s 7.7% rise.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $2.4 trillion by 2028 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Recommendations from previous editions of this report have produced gains of +205%, +258% and +477%. The stocks in this report could perform even better.

See these 7 breakthrough stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report