TechnipFMC plc

FTI

formed an alliance with Loke Marine Minerals (or Loke) to establish enabling technologies for the extraction of seabed minerals in Norway.

As the energy transition continues to gain momentum, TechnipFMC is targeting several market opportunities in the energy transition to address the increasing needs for clean energy technologies and resources.

Seabed minerals have been identified by global bodies like The World Bank, World Economic Forum and International Energy Agency as a potent resource in meeting the ever-increasing demand for metals in diverse areas. This includes electric vehicle batteries, clean energy technology and consumer electronics.

Hence, TechnipFMC invested in a minority stake in Loke, which is a leading provider of marine minerals for the green energy transition. TechnipFMC has an 18% minority ownership interest in marine mineral explorer Loke. Wilhelmsen Holding and NorSea Group have also taken an ownership interest in Loke, holding an 18% stake jointly.

TechnipFMC and Loke are developing a patent-pending, autonomous subsea production system, with minimum environmental impacts. The production system would position TechnipFMC well for potential offshore licensing for seabed minerals on the Norwegian Continental Shelf (“NCS”) and elsewhere. The NCS is known to have metals like copper, zinc, cobalt, and other rare earth elements.

Norway is one of the only countries to have formalized marine mineral legislation and is considering taking a leading role in seabed mineral exploration. The Norway government is likely to make a final decision on licensing approval for deep-sea exploration and production in 2023.

Notably, TechnipFMC’s expertise in subsea robotics and extensive history on the NCS can help meet the rising demand for new technologies and resources, which are driving the energy transition.

Company Profile & Price Performance

TechnipFMC is a leading manufacturer and supplier of products, services and fully integrated technology solutions for the energy industry. It operates through two business segments — Subsea Technologies and Surface Technologies.

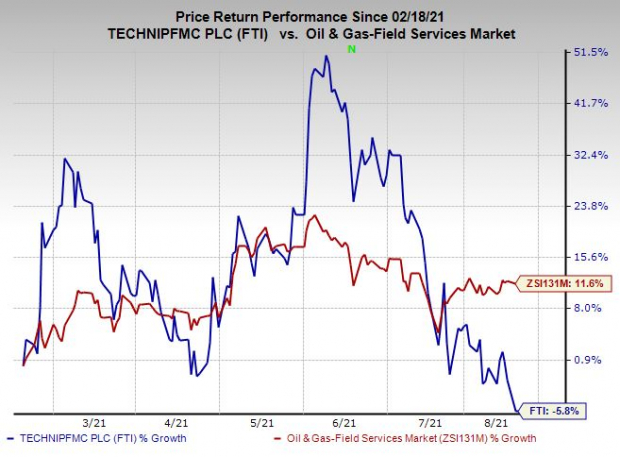

Shares of the company have underperformed the

industry

in the past six months. Its stock has declined 5.8% compared with the industry’s 11.6% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

TechnipFMC currently carries a Zack Rank #3 (Hold).

Some better-ranked players in the energy space are

Canadian Natural Resources Limited

CNQ

and

Matador Resources Company

MTDR

, each currently sporting a Zacks Rank #1 (Strong Buy), and

Earthstone Energy, Inc.

ESTE

, carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Over the past 60 days, the Zacks Consensus Estimate for Canadian Natural’s 2021 earnings has been raised by 23.1%.

Matador’s earnings for 2021 are expected to rise 35.3% year over year.

Earthstone’s earnings for 2021 are anticipated to increase 40.6% year over year.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report