Tellurian Inc.

TELL

entered a long-term agreement with Gunvor Singapore Pte Ltd to deliver three million tons per annum (Mtpa) of Liquefied Natural Gas (“LNG”) from its Driftwood LNG production and export terminal in Louisiana.

The Driftwood LNG project, which is expected to come online in 2023, involves the establishment of a 27.6-Mtpa LNG terminal and 154.5 kilometers of feed gas pipeline. Notably, Tellurian will supply LNG to commodity trader Gunvor from the proposed LNG facility in the United States Gulf Coast on a free on board (“FOB”) basis for ten years.

The Driftwood project is currently being developed in four phases. Tellurian mentioned that the first phase of the project would cost $16.8 billion and is expected to produce 16.5 Mtpa of LNG. Notably, the facility will boast five LNG plants, with each consisting of one gas pre-treatment unit for condensate and water removal, and four liquefaction units.

In 2019, Tellurian signed a memorandum of understanding with India-based Petronet for the supply of up to 5 Mtpa of LNG from the Driftwood facility. The agreement also included an investment of $2.5 billion for an 18% stake in Tellurian’s Driftwood LNG terminal. However, Petronet stepped away from making an investment, citing the fuel’s abundant supply at cheap prices.

LNG made a significant rebound in recent times from a pandemic-induced demand collapse as nations like India and China purchased more of the fuel to address the increasing energy needs and reduce the reliance on coal. Most importantly, the demand for LNG is expected to increase henceforth, as energy companies are switching to carbon neutrality in the coming years.

On its part, the agreement is expected to generate $12 billion in revenues over the ten years based on current LNG prices. It marks considerable progress for Tellurian in its commercial efforts, following a two-year break in firm activity.

Company Profile & Price Performance

Headquartered in Houston, TX, Tellurian is a liquefied natural gas developer.

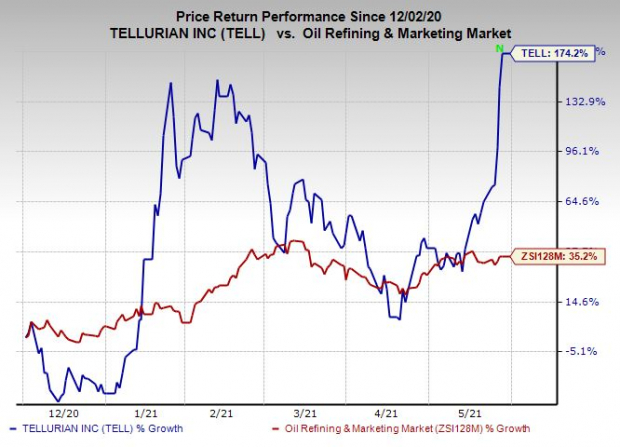

Shares of the company have outperformed the

industry

in the past six months. Its stock has gained 174.2% compared with the industry’s 35.2% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Tellurian currently carries a Zack Rank #4 (Sell).

Some better-ranked players in the energy space are

Hess Midstream Partners LP

HESM

,

TOTAL SE

TOT

and

Earthstone Energy, Inc.

ESTE

, each currently carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Hess’ earnings for 2021 are expected to increase 14.7% year over year.

TOTAL’s earnings for 2021 are expected to rise 8.7% year over year.

Earthstone’s earnings for 2021 are expected to increase 31.9% year over year.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%.

You’re invited to check out

Zacks’ Marijuana Moneymakers: An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report