Theravance Biopharma

TBPH

announced disappointing data from a phase III study (Study 0170), which evaluated its investigational pipeline candidate, ampreloxetine, for the treatment of symptomatic neurogenic orthostatic hypotension (nOH).

The Study 0170 — comprising of a 16-week open-label period followed by a 6-week randomized withdrawal period — evaluated ampreloxetine in comparison with placebo in a broad group of participants that included patients with neurological or neurdenegerative disorders like Parkinson’s disease (PD), pure autonomic failure (PAF) and multiple system atrophy (MSA).

The study failed to achieve statistical significance in its primary endpoint of treatment failure at week 6 of the randomized withdrawal period for the overall population of patients. Treatment failure is defined as worsening of both Orthostatic Hypotension Symptom Assessment Scale (OHSA) question #1 and Patient Global Impression of Severity (PGI-S) scores by 1.0 points. Nonetheless, study participants who were dosed with ampreloxetine did achieve a 40% reduction in the odds of treatment failure compared to placebo.

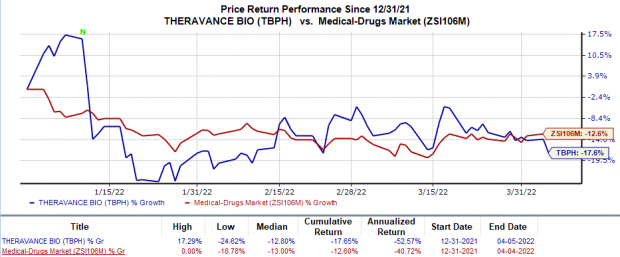

Shares of Theravance have declined 17.7% so far this year compared with the

industry

’s 12.6% decrease.

Image Source: Zacks Investment Research

Despite the disappointing results, Theravance conducted a sub-group analysis based on disease type wherein it was observed that MSA patients who received ampreloxetine achieved a 72% reduction in the odds of treatment failure as compared to placebo.

MSA is a rare, degenerative neurological disorder that currently has no cure or any disease-modifying treatments. The benefits to the MSA patient group were also seen in multiple endpoints including OSHA composite, Orthostatic Hypotension Daily Activities Scale composite, Orthostatic Hypotension Questionnaire composite and OHSA #1. The company also plans to conduct further analysis of data on PD and PAF patient groups to observe any benefits from the drug’s use.

This is the second phase III study evaluating ampreloxetine in symptomatic nOH, which failed to achieve its primary endpoint. Last September, the company

announced

data from a phase III study (Study 0169), which also evaluated the candidate in symptomatic nOH. The Study 0169 failed to show an improvement in its primary endpoint of sOHSA #1 in patients with symptomatic nOH.

The failure of two non-respiratory disease-related pipeline candidates, ampreloxetine and izencitinib, in mid-stage and late-stage studies, respectively, led Theravance to announce a major cost-reduction program in 2021, which also included undertaking strategic actions to prioritize marketed and investigational respiratory therapeutics to maximize shareholder value in the long run. The company also stated that it will halt the development of all non-respiratory disease-related programs.

Theravance plans to start exploring strategic partnerships and set up meetings with health authorities to discuss and explore ampreloxetine’s potential as a therapy for MSA patients suffering from symptomatic nOH.

Currently, the company has no marketed drugs in its portfolio. The top line comprises revenues earned from TBPH’s collaboration agreement with

Viatris

VTRS

. Both Theravance and Viatris have a collaboration to commercialize Yupelri, a long-acting muscarinic antagonist, as a once-daily nebulized treatment of chronic obstructive pulmonary disease. Per the collaboration terms, Viatris and Theravance are sharing U.S. profits and losses related to the commercialization of Yupelri. While Viatris gets 65% of the profits, Theravance receives 35%. TBPH is also entitled to low double-digit royalties on ex-U.S. net sales.

Zacks Rank & Stocks to Consider

Theravance Biopharma currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include

AVROBIO

AVRO

and

Collegium Pharmaceutical

COLL

. While AVROBIO carries a Zacks Rank #2 (Buy), Collegium Pharmaceutical sports a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Collegium Pharmaceutical’s earnings per share estimates for 2022 have increased from $3.79 to $5.76 in the past 60 days. The same for 2023 has increased from $4.79 to $7.96 in the past 60 days. Shares of COLL have risen 3% year to date.

Earnings of Collegium Pharmaceutical missed estimates in three of the last four quarters and beat the mark on one occasion, with the negative surprise being 57.6%.

AVROBIO’s loss per share estimates for 2022 have narrowed from $2.16 to $2.02 in the past 60 days. The same for 2023 has narrowed from $1.81 to $1.80 in the past 60 days.

Earnings of AVROBIO beat estimates in two of the last four quarters while missing the mark in the other two, delivering an average surprise of 2.6%.

Just Released: The Biggest Tech IPOs of 2022

For a limited time, Zacks is revealing the most anticipated tech IPOs expected to launch this year. Concerns about Federal interest rates and inflation caused many private companies to stay on the bench- leading to companies with better brand recognition and higher growth rates getting into the game. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity. See the complete list today.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report