There could be any number of reasons for the surge in a company’s share prices.

At times, it’s nothing more than market movers adjusting positions. As day traders see prices rise, they get into the stock, adding a bit of additional momentum. But this kind of price movement may not last long enough to generate substantial gains and trading them could be risky.

Shares also respond positively to positive news.

So for instance, the company may have agreed to acquire another at a great valuation, or to bring key assets, or for competitive advantage, etc. Conversely, the company may agree to be taken over at an attractive price. In this case, investors are likely to bid up the price to a level close to the agreed upon price, because this gives them a sure and quick opportunity to lock in some gains.

New product announcements, if they are likely to make a material difference to the company’s results in the near-to-medium term may also send shares up. Like NVIDIA’s product launch event that positioned the company as the undisputed leader serving emerging end markets including AVs, ML, etc.

An industrywide phenomenon such as a component shortage can also be a positive development for companies trading in them. Like the lumber shortage is making some traders rich as they recover high prices from customers with big demand.

So there could be many reasons for share prices suddenly popping. But for long-term investors, not all news is actionable. Meaning it’s probably not a good idea to jump into a stock just because other people are doing it.

You’d do better to consider your personal goals for investment of cash and its use. The market will do what it will, and there will be opportunities at most times to make gains, if you’re patient. So if you’re investing for the long term, small movements up or down shouldn’t make you sit up. You want to get accustomed to seeing the longer-term trend. And the longer-term trend is positive for those stocks that are going somewhere.

One of the things that you could do when you see a sudden price increase is to check its rationality. If it makes sense based on the facts, you could act on it. So for instance, if management says that its latest acquisition will help the company cut losses and/or be immediately accretive to the bottom line, this would be a good reason for appreciation in share prices.

In fact, it has been seen historically, that an upward revision in earnings estimates almost invariable leads to share price increases, whether immediately or over a period of time. Therefore, it makes sense to check whether rising prices are coming on the back of estimate revisions. And if they are, this could be a good opportunity to invest.

Let’s see some examples-

ACM Research, Inc.

ACMR

The Fremont, CA-based company develops, manufactures and sells single-wafer wet cleaning equipment, which semiconductor manufacturers can use in numerous manufacturing steps to remove particles, contaminants and other random defects.

We already know that there’s currently an ongoing chip shortage and chip manufacturers can’t get the things out fast enough. So there’s a good industrywide driver for this company.

Now we see that the current-year estimates just jumped 10 cents 7 days ago. Being a 7.5% increase, it may be considered substantial. The 2022 estimate also increased. So analysts are baking in a positive trend in the estimate. What’s more, they’re expecting strong double-digit percentage increases in revenue and earnings both this year and the next.

So, if the Zacks #2 (Buy)-ranked company’s shares jumped 14.8% over the past week, there appears to be good reason for this.

And to ascertain whether there’s further upside in the cards (making investment in the shares worthwhile), we could take a look at the current price as a percentage of its 52-week range. If it’s not too high (in this case, it’s a mere 24.4%), there’s a good chance that further upside is possible.

Alto Ingredients, Inc.

ALTO

The Sacramento, CA-based company is a producer of specialty alcohol and essential ingredients used in healthcare products, home and beauty products; food and beverages; essential ingredients and renewable fuels.

In this case too, there’s a strong industrywide factor that can be serving as the wind beneath its wings. The company sells industrial alcohol, which as we know is in high demand for use in sanitizers. This demand is unlikely to reduce in the near term as coronavirus fears keep popping up every once in a while, and new strains leading to new waves of infection can’t be ruled out. At any rate, the pandemic has also been habit-altering to a certain extent, a trend that favors use of more hand sanitizers going forward.

So we should probably get used to price increases from this stock, as it pays down its debt and other obligations, or sees continued strong demand. This Zacks Rank #2 company has see its share price appreciate 10.8% over the past week.

And, no surprise, the Zacks Consensus Estimate for its 2021 earnings went from 5 cents to 44 cents 7 days ago. The 2022 estimate went from 82 cents to 93 cents.

The lone analyst covering the stock currently expects revenue to increase 5.1% this year and 4.2% in the next. But earnings are a different story: to increase 450.0% this year and 111.4% in the next.

What’s more, its current price is 59.8% of its 52-week range, so we can safely say that there’s some room for further upside.

Cerence Inc.

CRNC

Burlington, MA-based Cerence provides A.I. powered assistants and innovations for connected and autonomous vehicles.

Although currently a relatively small player, the company operates in an attractive emerging industry that is set to increase in leaps and bounds over the next few years.

The Zacks Rank #1 (Strong Buy) stock has seen a share price increase of 11.6% in the past week and encouragingly, it has been on the back of notable revision in estimates.

For the current year, the Zacks Consensus Estimate increased 13.6% 7 days ago. For the following year, the estimate increased 8.2%. Analysts currently expect revenue and earnings growth of 18.0% and 39.3%, respectively this year (ending September). They expect increases of 9.8% and 12.4% next year.

The current price is 63.8% of its 52-week range, so further upside is possible.

GrowGeneration Corp.

GRWG

Headquartered in Pueblo, CO, GrowGeneration owns and operates specialty retail hydroponic and organic gardening stores. Its product range includes organic nutrients and soils, advanced lighting technology and state of the art hydroponic equipment to be used indoors and outdoors by commercial and home growers. It operates primarily in Colorado, California, Las Vegas, Rhode Island and Washington.

This is essentially a pandemic play, but also a play on the at-home operating model that is not going away entirely as we can now see.

After the 3-cent increase for the current year and 6-cent increase for the following year 7 days ago, analysts are currently looking for a 363.6% earnings increase in 2021 and a 36.0% increase in 2022. Revenue is expected to increase 139.0% and 29.9%, respectively in 2021 and 2022.

The Zacks Rank #2 company’s shares jumped 19.0% in the past week, but since they are at 65.5% of their 52-week range, further upside seems possible.

SiTime Corporation

SITM

Santa Clara, CA-based SiTime Corporation offers MEMS-based silicon timing system solutions through its wholly-owned subsidiary called MegaChips Corporation.

The company is seeing very strong order momentum leading to extended visibility (more than half the bookings in the first quarter were for deliveries five to 12 months out). The strength is at least partly attributable to the fear of shortage, as the need for timing solutions with higher precision, smaller size and higher resilience skyrockets, and the company’s solutions find their way into an increasing number of the connected devices that we see all around us. There are multiple tailwinds for continued strong growth through the next few years.

The Zacks Consensus Estimate for SiTime’s 2021 earnings jumped 22.8% 7 days ago, while that for 2022 jumped 6.9%. Analysts currently expect revenue and earnings growth of a respective 44.1% and 145.7% in 2021. For 2022, they expect revenue and earnings to increase 17.8% and 37.2%, respectively.

Shares of this Zacks Rank #2 company were up 11.3% over the past week. But since they remain at 57.8% of their 52-week range, further upside is a definite possibility.

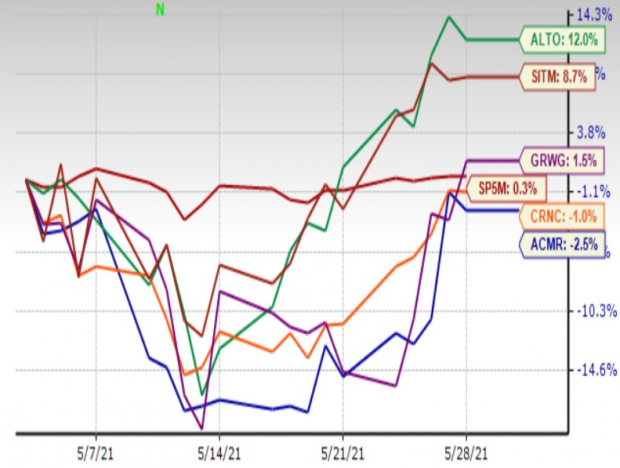

One-Month Price Movement

Image Source: Zacks Investment Research

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “”the world’s first trillionaires.”” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report