Turtle Beach Corporation

’s

HEAR

subsidiary, Neat Microphones, recently announced the commercial availability of its much-awaited Bumblebee II USB Microphone in the United States. The device, which is the successor to the original Bumblebee mic, is considered ideal for gamers, podcasters, content creators and musicians.

The Bumblebee II Professional Cardioid USB Condenser Microphone is part of Turtle Beach’s holiday season product roster. HEAR’s 2021 robust and augmented product portfolio is likely to strengthen its commitment to introducing industry-leading features by consistently leveraging its in-depth expertise to drive innovation in the global market.

Turtle Beach’s line-up of wireless gaming headsets has been highly appreciated by customers, one of them being the Bumblebee II USB Microphone. It is an easy-to-use USB condenser microphone that has been specifically designed to deliver professional-quality 24 bit/96 kHz digital audio output. Its cardioid polar pattern eliminates unwanted external sounds, thereby providing great clarity.

Bumblebee II is compatible with desktops, laptops and any other device with a USB port. It is equipped with a zero-latency headphone monitor backed by mic gain control, volume control and mix control for playback and monitoring sources. Thanks to its shock-mounted, medium-sized 25mm condenser capsule and higher resolution digital circuitry, Bumblebee II offers a flawless vocal presentation.

Further, its sleek and durable yoke-mounted desk stand enables stability on any surface. A USB Type C to USB Type A cable is also included. The Bumblebee II microphone is available at an attractive MSRP of $99.99. It is currently available at participating retailers like American Music Supply, zZounds and Sweetwater, among others.

In early 2021, Turtle Beach acquired Neat Microphones — the maker of high-quality digital USB and analog microphones. Neat has launched more than 60 products since founding Blue Microphones in 1995. The acquisition facilitated HEAR’s entry into the $2.3 billion global microphone market.

It also expanded the audio technology company’s total addressable market for its brands from $5.1 billion to $7.4 billion. HEAR has added almost 40 Neat patents and 70 Neat trademark registrations to its portfolio due to the buyout. In 2021, Neat plans to launch updated versions of some of its popular analog and digital microphones. The company is developing the next-gen products to meet the growing demand for high-quality, affordable microphones.

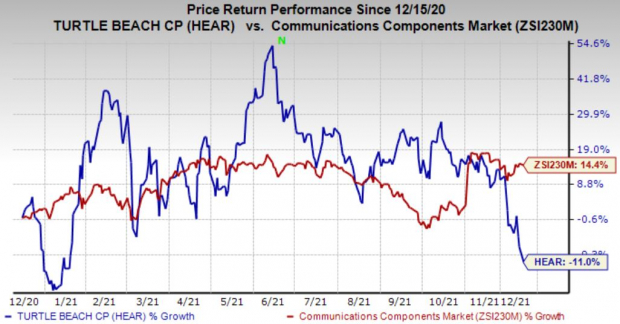

HEAR currently has a Zacks Rank #4 (Sell). Its shares have declined 11% against the

industry

’s growth of 14.4% in the past year.

Image Source: Zacks Investment Research

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Clearfield, Inc.

CLFD

sports a Zacks Rank #1. The Zacks Consensus Estimate for its current-year earnings has been revised 8.8% upward over the past 60 days.

Clearfield delivered a trailing four-quarter earnings surprise of 50.8%, on average. It has surged 148.8% in the past year.

Harmonic, Inc.

HLIT

carries a Zacks Rank #2 (Buy). The consensus estimate for current-year earnings has been revised 23.1% upward over the past 60 days.

Harmonic delivered a trailing four-quarter earnings surprise of 61.1%, on average. The stock has appreciated 50.5% in the past year. HLIT has a long-term earnings growth expectation of 15%.

Qualcomm Incorporated

QCOM

is another solid pick for investors, carrying a Zacks Rank #2. The consensus estimate for current-year earnings has been revised 14.1% upward over the past 60 days.

Qualcomm delivered a trailing four-quarter earnings surprise of 11.2%, on average. It has gained 23.6% in the past year. QCOM has a long-term earnings growth expectation of 15.3%.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report