“Past performance is not a guarantee of future results.”

If you’ve been around the investing world you’ve definitely seen this phrase. This disclaimer is necessary as the word ‘guarantee’ is a big no-no in the financial industry. The truth is nothing is guaranteed. Stocks can experience drastic price moves – both positive and negative – in a very small window of time.

Although events outside of our control can dictate portfolio performance in the short-term, history has shown that investors who buy and hold the best companies over time tend to do very well. While prior performance certainly does not guarantee results, analyzing how the market has reacted in similar environments from the past can help us understand what

may

happen in the future. In the markets, history rarely repeats itself exactly – but it often rhymes.

Let’s take a look at the present market environment.

We are in the midst of one of the greatest bullish moves in history. The S&P 500 has realized a total return of more than 112% since the March 2020 bottom. Companies are posting record earnings even in the face of higher inflation. Coming off this historic run, investors may feel cautious and question if this rally has more legs.

Barring any dramatic price changes in the final trading days of this year, 2021 will be the 3

rd

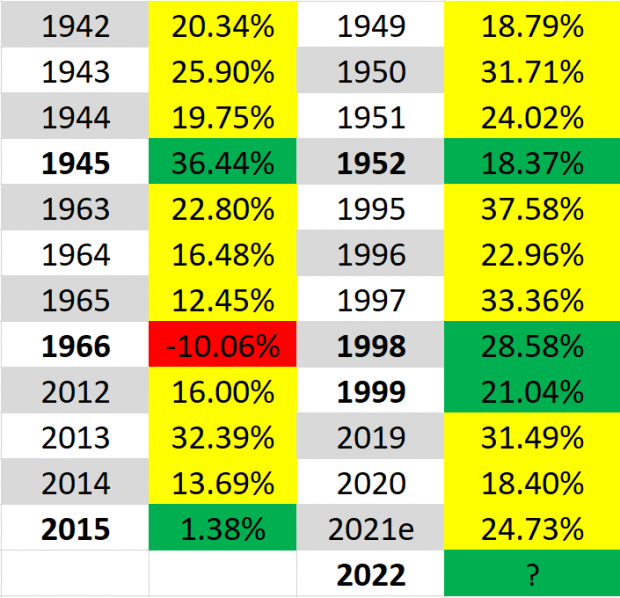

year in a row in which the S&P has posted a total return in double-digit territory. Since 1942, there have been six previous times where the S&P delivered a similar three-year stretch of double-digit gains. How did the S&P 500 perform in each of the following years?

S&P 500 Annual Returns (Including Dividends)

Image Source: Zacks Investment Research

As we can see, the results are favorable with an average gain of nearly 16% and a positive return 83% of the time. Keep in mind that there are only six instances of this type of performance which is an extremely small sample size. These figures don’t predict anything – they simply speak to probabilities. Instead of trying to predict a certain outcome for next year, what can we learn from this historical analysis?

In viewing annual index returns, it becomes apparent that above-average gains can cluster together and may last longer than most people would think. These performance stretches have occurred during periods of strong corporate earnings growth and high levels of innovation. This analysis helps us keep an open mind about better-than-expected outcomes.

On the flip side, the second year of a presidential term has historically been quite weak. Since 1950, year 2 of the presidency has been positive just 64% of the time. When viewing presidential cycle returns in isolation, there is over a one-third chance that next year will see negative returns. This helps us keep an open mind about worse-than-expected outcomes.

As investors we want to maintain flexibility and adapt to the market environment. The trend is certainly up right now. Heading into next year, we recommend sticking with market leaders that have proven their ability to innovate and exceed earnings estimates. Let’s delve deeper into three medical companies that exhibit these characteristics.

Edwards Lifesciences Corp. (

EW

)

Edwards Lifesciences provides products and technologies to treat late-stage cardiovascular disease. Headquartered in Irvine, CA, Edwards Lifesciences is the world’s leading manufacturer of tissue replacement heart valves that are used to replace a patient’s defective or diseased heart valve. EW’s product line also includes angioscopy equipment, oxygenators, monitoring devices, and pharmaceuticals.

EW has beaten earnings estimates in six of the last seven quarters, helping the stock advance over 30% on the year. The company has a trailing four-quarter average earnings surprise of 6.87%. EW most recently reported EPS in October of $0.54, a 1.89% surprise over estimates.

Image Source: Zacks Investment Research

What the Zacks Model Unveils

The Zacks Earnings ESP (Expected Surprise Prediction) seeks to find companies that have recently seen positive earnings estimate revision activity. This technique has proven to be quite useful for finding positive earnings surprises. In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time according to our 10-year backtest.

With a positive ESP of +0.34% and a Zacks #3 Hold ranking, our model predicts an earnings beat when EW reports on January 26

th

.

The Zacks Consensus Estimate for full-year EW EPS stands at $2.26, translating to 21.51% growth over 2020 EPS.

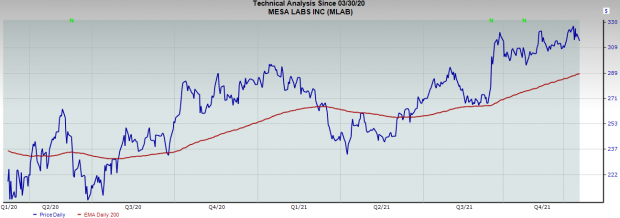

Mesa Laboratories, Inc. (

MLAB

)

Mesa Laboratories designs, develops, and manufactures instruments and systems used in connection with industrial applications and hemodialysis therapy. Headquartered in Lakewood, CO, the company’s product line includes a diverse set of biological indicators, data loggers, monitoring systems, calibrators and related instruments.

MLAB is a Zacks #1 Strong Buy stock and has posted an average earnings surprise of 18.05% over the previous four quarters. MLAB most recently reported EPS of $1.49 back in November, a +67.42% surprise over consensus.

Image Source: Zacks Investment Research

Revenues for the present year are expected to jump more than 30% compared to 2020. The Zacks Consensus Estimate for full-year EPS sits at $8.10, a nearly 15% growth rate relative to last year. MLAB is scheduled for its next earnings announcement on February 2

nd

, 2022.

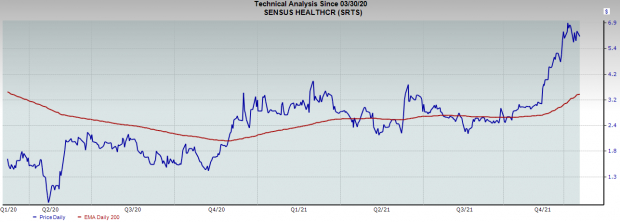

Sensus Healthcare, Inc. (

SRTS

)

Sensus Healthcare is a medical device company that specializes in the treatment of non-melanoma skin cancers and other skin conditions. Headquartered in Boca Raton, FL, Sensus Healthcare has built a portfolio of skin treatment devices and utilizes superficial radiation therapy.

Also sporting a Zacks #1 ranking (Strong Buy), SRTS has exceeded earnings estimates in each of the past six quarters. SRTS has delivered an average earnings surprise of 108.06% over the past four quarters, supporting the stock’s 84% ascent this year. SRTS most recently reported earnings in November of $0.01, a 200% surprise over consensus.

Image Source: Zacks Investment Research

Looking out at next year, analysts covering SRTS have upped their estimates for 2022 earnings by a whopping 62.5% over the past 60 days. The Zacks Consensus Estimate for 2022 earnings now stands at $0.26, which would represent an incredible 1,416.67% growth rate over 2021. SRTS is scheduled to report earnings on February 24

th

, 2022.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report