The healthcare industry is one of the fastest growing in the world, but today, it’s seeing a major disruption.

With everything from work meetings to family gatherings going digital since 2020, this mammoth $12 trillion industry is joining the new tech renaissance to deliver a much-needed overhaul.

That’s why trillion dollar Big Tech companies like Google, Amazon, and Apple are all trying to make a move into healthcare.

Now, the way people make decisions about their health is beginning to look drastically different from how it did 24 months ago.

The Wall Street Journal

says, “Tech advances put the annual doctor visit on the critical list.”

And

Forbes

says, “Artificial intelligence offers an unprecedented opportunity to… reshape the practice of healthcare.”

The shift towards a new “Healthcare 2.0” could soon be the biggest disruption to a trillion dollar industry since Amazon took over retail or Netflix changed the face of entertainment.

And while Big Tech is doing their best to make a move into this industry…

Treatment.com International Inc. (

CSE: TRUE

;

OTC: TREIF

)

holds a key advantage that gives them a huge leg up on Silicon Valley’s finest and has a distinct North American heritage, unlike many competitors.

Here are 5 reasons why you should pay close attention to Treatment.com:

1 – Billions of People are Embracing “Healthcare 2.0”

Over 1 billion people now use Google to research health symptoms each and every day, as Google has tried its best to leverage this into a new arm of the company.

Amazon jumped in with Amazon Care, offering up live chat or video care with clinicians when you have a problem.

And with Apple’s iOS15 rolling out, they’ve

made it possible

to share data from your iPhone’s “Health” app directly with doctors through electronic medical records.

There’s a staggering number of people taking their health into their own hands before they ever make it to the doctor’s office.

But many have serious reservations about trusting Big Tech with their most sensitive health data given their history of privacy issues. Built by doctors for doctors, this tri-level enterprise software, presents a unique big tech platform to healthcare with The Global Library of Medicine, known as (GLM).

Treatment.com’s big tech platform technology, on the other hand, is already being used to train and test medical students at the University of Minnesota Medical School, a top 10 med school in the United States.

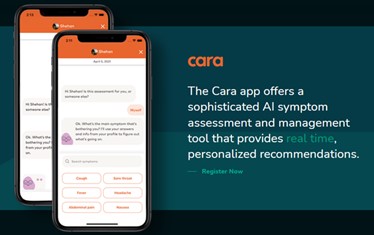

Now, their new app, CARA, plans to take that same powerful technology and deliver it to your cell phone.

CARA takes a unique approach that personalizes this data to give you the most accurate health information possible.

Using the latest AI technology and input from top physicians across the globe, CARA has been trained to think like a doctor.

It considers everything from your age and gender to your medical history and unique risk factors.

Now their new mobile app, which puts the power of great doctors at your fingertips, is expected to be unveiled across North America this fall.

With over 1 billion people taking their healthcare into their own hands, the CARA app could make a huge splash as it appears in app stores in the coming months.

2 – Billions of Dollars Changing Hands in the Industry

As technology has started playing a bigger and bigger role in healthcare, the amount of money behind it is reaching a fever pitch.

Last year, healthcare company

Olive acquired Verata Health for $120 million

.

Medtronic

paid $158 million to acquire AI-driven tech company Medicrea

.

And Microsoft made headlines when they

acquired health tech company Nuance Communications for a whopping $19.7 billion

.

That’s approximately

125x

the size of Treatment.com as it stands today.

With millions – and even billions – of dollars changing hands in the industry, these small healthcare tech companies are precious gems just waiting to be scooped up.

And Treatment.com’s (

CSE: TRUE

;

OTC: TREIF

) potential to drive valuable revenue from multiple angles makes it potentially even more appealing to the big players in the industry.

First, they’ll charge a flat monthly fee comparable to a Netflix subscription for their premium app, where you can get access to services like telemedicine, prescription, and other referrals.

Second, as Treatment.com’s technology is already being used in a top 10 medical school to train med students, they also plan to license the technology to universities for a monthly fee as well. And the scalable plug and play GLM platform has many more modules planned for release in the future. Treatment Mobile, Cara is the tip of the iceberg.

Plus, it’s been tested in clinics to help streamline appointments and help doctors spend more time with their patients and less time on paperwork.

Since this could help drive up revenue in clinics, it’s well worth paying a monthly licensing fee for this tech in this setting as well.

Finally, if they’re able to catch the eye of insurance companies in the future, Treatment.com could be sitting on a cash cow with their new app.

How much do you think it would be worth for insurance companies to help potentially cut down on healthcare costs, getting ahead of major medical problems or cutting out unnecessary doctor’s visits?

It’s safe to say that given the potential benefits for everyone – consumers, physicians, and insurance companies alike… Treatment.com could be a prime takeover target in the new age of Healthcare.

3 – Built to Get Smarter All The Time

While Treatment.com’s (

CSE: TRUE

;

OTC: TREIF

) technology is incredibly complex, the way it works is simple.

Users can enter their symptoms, and CARA will provide the most likely diagnoses, preventative measures, and potential treatments.

Plus, the app helps you track symptoms over time and manage issues for everyone in the family on one account.

It can even integrate with popular wearables like the Apple Watch and Fitbit which have soared in popularity…

Helping provide monitoring for important health data by integrating data in real-time.

Treatment.com’s AI engine pinpoints the most likely diagnoses by tapping into the most advanced medical database in the world, the Global Library of Medicine.

It’s currently able to offer around 800 diagnoses.

But soon, that could rise to all 1,200 primary care diagnoses and eventually all 8,000 to 10,000 known diseases.

In the past, doctors have had to wait years between editions of their medical textbooks as science continued to progress further every day.

The GLM is a platform like Apple’s iOS or Microsoft Windows that’s continuously being updated with the most cutting-edge medical data.

And because the database is constantly being updated and the machine learning technology helps refine the algorithms…

Treatment.com’s technology is getting smarter and more accurate all the time.

It’s all because some of the smartest physicians and data scientists in the world have been working on this project for years, set to unveil this fall.

4 – World-Class Team With a Billion Dollar Track Record

Over the last 5 years, Treatment.com’s (

CSE: TRUE

;

OTC: TREIF

) global team of top doctors have been working tirelessly to build their technology to think like a doctor.

They’ve come together with a team of top AI scientists, mathematicians, and PhDs in statistics to bring the technology to life.

And one look at their leadership team is enough to see the kind of billion-dollar potential that could lie ahead for Treatment.com.

Their CMO, Dr. Kevin Peterson, is an internationally-known researcher and tenured professor at a top medical school.

He’s been in the business of training others in the medical field at the highest levels for over 35 years.

With that experience, there’s almost nobody more qualified to train their AI technology how doctors truly think.

Pair that experience with the business credentials of CEO, John Fraser, and the business potential becomes even more exciting.

Fraser led another healthcare tech company, Ability Networks, until it was acquired by Inovalon in 2018 for a massive $1.2 billion.

Now he’s hoping to follow that same blueprint with some of the world’s top doctors where the potential user base could be well over a billion people.

Even if they manage to get a small sliver of that to download the CARA app, the potential profits for Treatment.com could be mind-boggling.

5 – Timing is Everything

We’ve already seen how Big Tech companies are piling into the healthcare industry at breakneck speed…

Small companies are raking in millions or more when acquired by larger healthcare companies…

And Treatment.com’s leadership has already proven their chops with a billion dollar track record.

Now their CARA app could have patients, doctors, and insurance companies chomping at the bit to get their hands on it, as over 1 billion people are embracing the new face of healthcare.

And it’s all set to begin this fall as Treatment.com (

CSE: TRUE

;

OTC: TREIF

) rolls out the app across North America.

They just teamed up with a leader in mobile apps, MentorMate, in the US to help scale the app and ensure it’s the most up-to-date on the market.

MentorMate has over 700 developers with 1,400 completed projects under its belts, and now it’s set to help make CARA’s launch a massive success.

But the app could spread far beyond just North America over time.

Treatment.com has staff in Europe, Africa, and Singapore as well.

If all goes well, they could play a major role in disrupting the massive $12 trillion healthcare industry worldwide.

And as it’s trading for under $3, it’s an exciting time to watch Treatment.com as they’re just weeks away from launching this new app across North America.

Other companies looking to capitalize on the healthcare boom:

Blackberry Limited (NYSE:BB, TSX:BB)

is one of Canada’s most exciting tech plays. While it has pivoted away from its iconic cell phones of yesteryear, it is still very much involved in pushing tech, and by extension all of mankind, further. It’s even building a global digitized healthcare database leveraging blockchain technology. This could be a game-changer for how health data is managed and distributed. But that’s just one facet of its big picture push. From it’s high-profile partnerships with the likes of Amazon and more, to its key posturing in the Internet of Things explosion, BlackBerry is tackling the industry from all fronts, and will be an important player for years to come.

BlackBerry also launched a new research and development arm called BlackBerry Advanced Technology Labs. “Today’s cybersecurity industry is rapidly advancing and BlackBerry Labs will operate as its own business unit solely focused on innovating and developing the technologies of tomorrow that will be necessary for our sustained competitive success, from A to Z; Artificial Intelligence to Zero-Trust environments,” Charles Eagan, BlackBerry CTO explained.

AEterna Zentaris Inc. (TSX:AEZS)

is a major biopharmaceutical up and comer. The company has seen steady growth, and an array of new developments over the recent years. With a focus on oncology, endocrinology, and women’s health solutions, AEterna has created a variety of new products, including Macrilen, the first and only FDA-approved oral test for the diagnosis of Adult Growth Hormone Deficiency.

Recently, AEterna received European approval to market Macrillen which has pushed its value even higher. Dr. Christian Strasburger, the Head of Clinical Endocrinology at Charité Unversitaetsmedizin Berlin and the principal investigator for macimorelin explained, “Clinical studies have demonstrated that macimorelin is safer and much simpler to administer than the current methods of testing for insulin-induced hypoglycemia, and is well-tolerated by patients and reliable in diagnosing the condition.”

Aptose Biosciences Inc. (TSX:APS)

is a biotech company specializing in personalized therapies to address Canada’s unmet oncology needs. The company uses genetic and epigenetic profiles to gain insights into certain cancers and patient populations in order to develop new treatments within the space.

Aptose has an exclusive partnership with Ohm Oncology to develop, manufacture and commercialize APL-581 in order to treat hematologic malignancies and related molecules.

The Hexo Corporation (TSX:HEXO),

as previously mentioned, made major waves with its partnership with Molson Coors to develop cannabis beverages. In Hexo’s fourth-quarter press release, the company shared some optimistic news regarding Truss’ progress, with Sebastien St-Louis, Hexo CEO and co-founder, explaining, “We are commanding significant market share in Quebec and this year we made major strides by launching Truss cannabis infused beverages in Canada in addition to our initial foray into the U.S. with Molson Coors, a world-class partner,”

The world is currently in the midst of a mental health crisis. Everything that could possibly go wrong, has. And to make matters worse, millions, if not tens of millions of people are stuck in isolation. It’s never been more important to support the field of mental health. And the FDA seems to agree. Not only have they fast-tracked psilocybin, they’ve also approved other exciting new approaches to tackling mental health issues.

Toronto-based

Field Trip Health (CSE:FTRP)

is taking a three-pronged approach in their work in the transformative psychedelic medicine sector. Not only are they involved in drug development, but they’re also involved in manufacturing and run a number of treatment clinics.

Field Trip has hit the ground running. With clinics currently operating in Toronto, Los Angeles, and New York, they have plans to ramp up to 75 clinics – providing psychotherapy along with psychedelic treatments. As one of the frontrunners in this exciting new industry, investors are keeping a close eye on Field Trip.

By. Josh Owens

** IMPORTANT NOTICE AND DISCLAIMER — PLEASE READ CAREFULLY! **

PAID ADVERTISEMENT

.

This article is a paid advertisement.

Advanced Media Solutions Ltd. and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Treatment.com International, Inc. Inc. (“Treatment.com” or “Company”) to conduct investor awareness advertising and marketing. Treatment.com paid the Publisher to produce and disseminate six articles profiling the Company at a rate of seventy-five thousand US dollars per article. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by Treatment.com) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP

. The Publisher owns shares and / or options of the featured company and therefore has an additional incentive to see the featured company’s stock perform well. The Publisher does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The Publisher will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS

. This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include, but are not limited to, the size and anticipated growth of the market for the company’s products, the anticipated growth of the market for AI-assisted products generally, the anticipated growth of the market for app-based products generally, the anticipated launch date for the company’s products, the anticipated growth of the market for health care app-based products generally, the anticipated launch date for the company’s products, and the anticipated growth and expansion of the medical library to which the company’s products have access. Factors that could cause results to differ include, but are not limited to, the companies’ ability to fund its capital requirements in the near term and long term, the management team’s ability to effectively execute its strategy, the degree of success of the AI technology used in the company’s products, the company’s ability to effectively market the company’s products to customers within its three anticipated revenue streams, supply chain constraints, pricing pressures, etc. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

INDEMNIFICATION/RELEASE OF LIABILITY

. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE

. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here

http://oilprice.com/Terms-of-Use

. If you do not agree to the Terms of Use

http://oilprice.com/Terms-of-Use

, please contact Advanced Media Solutions Ltd. to discontinue receiving future communications.

INTELLECTUAL PROPERTY

. oilprice.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.