Investors are likely to focus on pipeline updates when clinical-stage biopharmaceutical company,

Zosano Pharma Corporation

ZSAN

, reports

earnings results for the first quarter of 2022

.

The company’s surprise history has been mixed so far, with its earnings beating the Zacks Consensus Estimate in one of the trailing four quarters, meeting the same twice and missing once. In the last-reported quarter, Zosano delivered an earnings beat of 14.29%.

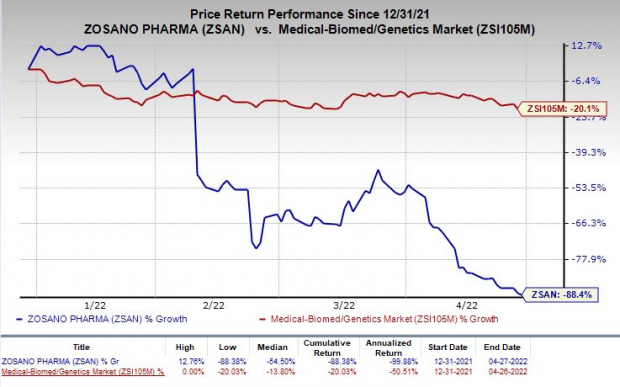

Shares of Zosano have plunged 88.4% year to date compared with the

industry

’s decrease of 20.1%.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for the quarter to be reported.

Factors at Play

In the absence of a marketed product in its portfolio, investors’ focus will be on the updates related to Zosano’s pipeline development.

The company’s lead product candidate, M207, is a proprietary formulation of zolmitriptan. It is designed to be delivered via its transdermal microneedle system technology as an acute treatment for migraine.

Zosano submitted a new drug application (“NDA”) for M207 to the FDA in December 2019. Subsequently, the company received a Complete Response Letter (“CRL”) from the regulatory body with respect to the NDA in October 2020. The CRL cited inconsistent zolmitriptan exposure levels observed across clinical pharmacology studies, which had been previously identified in the FDA’s discipline review letter. Back then, the FDA had recommended that the company should conduct a repeat bioequivalence study between the lots used during the development.

Based on feedback from the FDA, Zosano conducted an additional pharmacokinetic (“PK”) study on M207 for inclusion in the NDA resubmission package.

In January 2022, Zosano resubmitted the NDA for M207 and subsequently received a response letter from the FDA related to the same in February. In this response letter, the regulatory body stated that it did not consider the resubmitted NDA for M207 to be a complete response to the deficiencies identified previously in the CRL.

Investors will be keen to get an update on the company’s plans to evaluate the next steps of development for M207 at the upcoming earnings call.

Operating expenses are likely to have decreased in the to-be reported quarter on lower professional service fees and employee expenses, as well as a reduction in material purchases.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Zosano this time around. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Earnings ESP:

Zosano has an Earnings ESP of 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate currently stand at a loss of $2.80 per share.

Zacks Rank:

Zosano currently carries a Zacks Rank #3. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Stocks to Consider

Here are a few stocks you may want to consider as our model shows that these have the right combination of elements to beat on earnings this reporting cycle:

Applied Therapeutics, Inc.

APLT

has an Earnings ESP of +21.95% and a Zacks Rank #2.

Applied Therapeutics has a mixed track record, with the company exceeding earnings expectations in two of the trailing four quarters while meeting and missing the same once each. APLT delivered a four-quarter earnings surprise of 2.58%, on average. Loss estimates for 2022 have narrowed from $3.85 to $2.47 over the past 60 days.

Biogen Inc.

BIIB

has an Earnings ESP of +0.74% and a Zacks Rank #3.

Biogen has an excellent track record, with the company exceeding earnings expectations in each of the trailing four quarters. BIIB delivered a four-quarter earnings surprise of 11.72%, on average. Earnings estimates for 2022 are down from $15.84 to $15.38 over the past 60 days.

Axcella Health Inc.

AXLA

has an Earnings ESP of +2.83% and a Zacks Rank #2.

Axcella Health has a mixed track record, with the company exceeding earnings expectations in two of the trailing four quarters, while meeting and missing the same once each. AXLA delivered a four-quarter earnings surprise of 1.67%, on average. Loss estimates for 2022 have narrowed from $1.63 to $1.42 over the past 60 days.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar

.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report