Apellis Pharmaceuticals, Inc.

APLS

, along with its Swedish partner, Sobi, announced that they have dosed first patient in the phase III VALIANT study evaluating targeted C3 therapy, pegcetacoplan, to treat primary immune-complex membranoproliferative glomerulonephritis (IC-MPGN) and C3 glomerulopathy (C3G) — two rare and debilitating kidney diseases.

Both diseases, without any approved therapy at the moment, often lead to kidney failure.

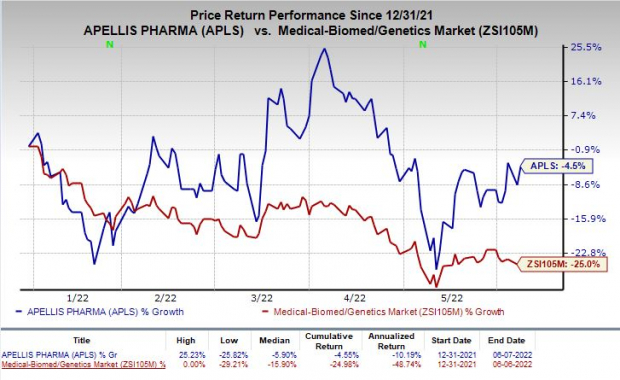

Shares of Apellis gained 4.6% on Wednesday following the announcement of the news. The stock has lost 4.5% so far this year compared with the

industry

’s decrease of 25%.

Image Source: Zacks Investment Research

The multi-center, placebo-controlled phase III VALIANT study will evaluate the safety and efficacy of pegcetacoplan in patients aged 12 years and above with primary IC-MPGN or C3G, including those with post-transplant recurrence.

The primary endpoint of the study is to check the proportion of study participants with a reduction from baseline in urine protein-to-creatinine ratio (uPCR), an important indicator of kidney function, of at least 50% at week 26.

Per the company, around 5,000 people in the United States and up to 8,000 in Europe are living with IC-MPGN or C3G while approximately half of them suffer from kidney failure within five to 10 years of diagnosis. Hence, if successfully developed and upon potential approval, pegcetacoplan can serve an area of high unmet medical need for people living with these rare kidney diseases.

In May 2021, the FDA

approved

pegcetacoplan (marketed as Empaveli) as a monotherapy treatment for adult patients suffering from paroxysmal nocturnal hemoglobinuria (“PNH”). A rare blood disorder, PNH is associated with abnormally low hemoglobin levels as the disease destroys red blood cells.

Empaveli is approved for treatment-naïve patients and for those switching from Alexion’s (now part of AstraZeneca) C5 inhibitor therapies for PNH, namely Soliris and Ultomiris.

Last December, the European Commission

approved

Aspaveli to treat adult patients with PNH who are anemic after treatment with a C5 inhibitor for at least three months. The drug is marketed under the trade name Empaveli in the United States.

Earlier this month, Apellis submitted a new drug application (“NDA”) to the FDA seeking approval of pegcetacoplan for the treatment of geographic atrophy secondary to age-related macular degeneration. The regulatory body’s decision on the NDA filing acceptance is expected in August 2022.

Also, the phase II MERIDIAN study is evaluating systemic pegcetacoplan for treating amyotrophic lateral sclerosis or ALS. Top-line data from the same is expected in mid-2023.

A potential label expansion of pegcetacoplan for additional indications will boost sales and drive growth for the company.

Zacks Rank & Stocks to Consider

Apellis currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector are

Leap Therapeutics, Inc.

LPTX

,

Anavex Life Sciences Corp.

AVXL

and

Precision BioSciences, Inc.

DTIL

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Leap Therapeutics’ loss per share has narrowed 11.1% for 2022 and 5.9% for 2023 in the past 60 days.

Earnings of Leap Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion. LPTX delivered an earnings surprise of 1.92%, on average.

Anavex Life Sciences’ loss per share estimates narrowed 6.6% for 2022 and 4.3% for 2023 in the past 60 days.

Earnings of Anavex Life Sciences have surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions. AVXL delivered an earnings surprise of 0.48%, on average.

Precision BioSciences’ loss per share estimates narrowed 21.7% for 2022 and 31.4% for 2023 in the past 60 days.

Earnings of Precision BioSciences have surpassed estimates in each of the trailing four quarters. DTIL delivered an earnings surprise of 76.15%, on average.

Zacks’ Top Picks to Cash in on Electric Vehicles

Big money has already been made in the Electric Vehicle (EV) industry. But, the EV revolution has not hit full throttle yet. There is a lot of money to be made as the next push for future technologies ramps up. Zacks’ Special Report reveals 5 picks investors

See 5 EV Stocks With Extreme Upside Potential >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report