BeiGene, Ltd.

BGNE

announced that the FDA has approved its marketed drug Brukinsa (zanubrutinib) for an additional indication. The drug has been approved for the treatment of adult patients with Waldenström’s macroglobulinemia (“WM”), a rare type of lymphoma. This marks the second FDA approval for Brukinsa in the United States.

The latest FDA nod was based on data from the phase III ASPEN study which compared Brukinsa to Imbruvica (ibrutinib) in adult patients with WM. Data from the same showed that treatment with Brukinsa improved tolerability across a number of clinically important side effects.

Imbruvica, which is an approved medicine for treating cancer, is jointly marketed by

AbbVie

ABBV

and

J&J

JNJ

across the world.

Per the company, the new indication for Brukinsa is likely to provide a new treatment option with demonstrated efficacy and safety benefits for patients with WM.

We remind investors that in February 2021, the FDA accepted BeiGene’s supplemental new drug application for Brukinsa for the treatment of adult patients with WM. A decision from the regulatory body was expected on Oct 18, 2021. Hence the above approval came before the scheduled period of time.

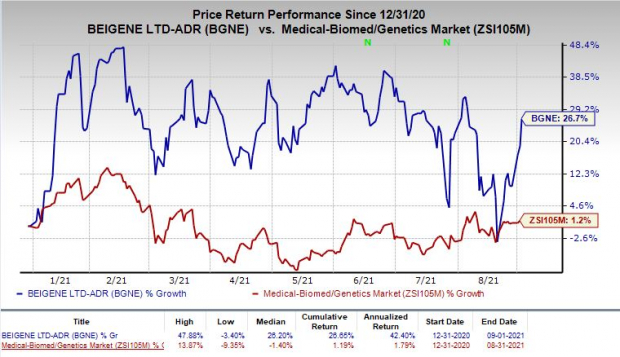

Shares of BeiGene have rallied 26.7% so far this year compared with the

industry

’s rise of 1.2%.

Image Source: Zacks Investment Research

Brukinsa is currently approved in the United States for the treatment of mantle cell lymphoma in adult patients who have received at least one prior therapy. The drug is also approved for other types of lymphoma indications in several other countries across the globe.

In the first six months of 2021, Brukinsa generated worldwide sales worth $64.5 million, reflecting a significant year-over-year increase.

BeiGene is currently evaluating Brukinsa as a monotherapy and in combination with other therapies to treat various B-cell malignancies in a broad clinical program. If successfully developed and upon potential approval in new indications, Brukinsa should boost sales for the company.

Zacks Rank & Stock to Consider

BeiGene currently carries a Zacks Rank #4 (Sell).

A better-ranked stock in the biotech sector is

Corvus Pharmaceuticals, Inc.

CRVS

, which has a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Corvus Pharmaceuticals’ loss per share estimates have narrowed 24.4% for 2021 and 21.4% for 2022, over the past 60 days.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don’t buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report