Top Biotech Stocks To Watch In Before July 2021

No matter the sentiment of the

stock market

, biotech stocks will always be on the radar of investors. For those new to the sector, you may wonder why. Well, the reason is quite simple. It is that top

biotech stocks

have arguably the highest potential to bring you quick huge profits. After all, it is every investor’s dream to land that one big winning trade. While this could seem like a great opportunity for diligent investors, it could be a catastrophe waiting to happen for those who invest blindly.

A good example of this would be Moderna Inc (

NASDAQ: MRNA

). Imagine if you had anticipated the company to be one of the pioneers in making the vaccine for COVID-19, you would’ve likely made quite a profit. Since the onset of the pandemic, MRNA stock has skyrocketed by more than tenfold. On that note, gene editing stocks have been trending over the weekend. So, could these companies be the next game-changer in the industry? Only time will tell. With all said and done, only you would know if it’s the type of investment that gets you excited. If so, here’s a list of some of the top

biotech stocks to watch

in the

stock market today

that you should be aware of.

Best Biotech Stocks To Watch In July 2021

-

Intellia Therapeutics Inc

(

NASDAQ: NTLA

) -

Regeneron Pharmaceuticals Inc

(

NASDAQ: REGN

) -

Atossa Therapeutics Inc

(

NASDAQ: ATOS

) -

Crispr Therapeutics

(

NASDAQ: CRSP

)

Intellia Therapeutics Inc

Let us start the list with the genome editing company, Intellia. Essentially, it focuses on developing therapeutics utilizing a biological tool known as CRISPR. The company’s in vivo programs include NTLA-2001 and NTLA-2002. NTLA-2001 is in Phase 1 clinical trial for the treatment of transthyretin amyloidosis. NTLA stock has risen by over 49% in Monday morning’s trading session and currently trades at $133.14 as of 9:45 a.m. ET. Let us see what has been the catalyst for this movement.

On Saturday, the company along with Regeneron Pharmaceuticals announced positive interim data from the ongoing Phase 1 clinical study for NTLA-2001. The trial found that a single 0.3mg/kg dose of NTLA-2001 led to an 87% mean reduction in serum transthyretin (TTR), with a maximum 96% serum TTR reduction by day 28, with a dose-dependent response. Also, it appears that there is an encouraging safety profile with no serious adverse effects by day 28.

This development matters because NTLA-2001 is the first Cas9-based therapy candidate to be used systemically through intravenous infusion, for precision editing of a gene in target tissue in humans. Also, it would imply that the drug has the potential to halt and reverse the complications of ATTR amyloidosis with a single dose. Therefore, should this candidate be a success, it could unlock the door to treating a wide array of other genetic diseases with its modular platform. So, would you invest in NTLA stock given the excitement around the company?

[Read More]

Top Fintech Stocks To Buy Right Now? 3 To Watch

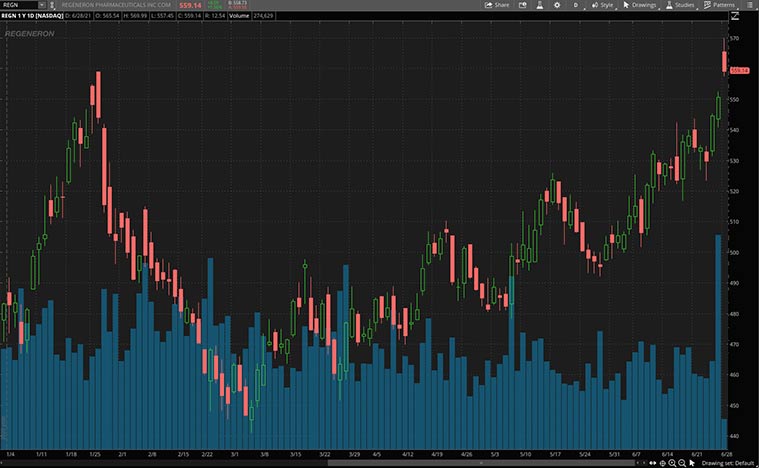

Regeneron Pharmaceuticals Inc

Another trending biotech company would be Regeneron. It is a biopharmaceutical company that discovers, invents, develops, manufactures, and commercializes medicines for the treatment of serious diseases. Naturally, the company is trending due to the positive interim results that were released as mentioned above regarding the drug candidate NTLA-2001. However, let us review some of the other exciting developments around the company.

The company and Sanofi SA (

NASDAQ: SNY

) today announced that the European Medicines Agency will update the Dupixent® summary of product characteristics adding long-term safety results for adults with moderate-to-severe atopic dermatitis. This is based on the positive opinion of the Committee for Medicinal Products for Human Use. As of today, Dupixent is the only drug approved in the European Union for children as young as six years with severe atopic dermatitis. So, this should increase the confidence of consumers who were skeptical of the long-term side effects of the drug.

Furthermore, the European Commission has also approved the PD-1 inhibitor Libtayo® (cemiplimab) to treat adults with locally advanced or metastatic basal cell carcinoma (BCC). Specifically for cases that have progressed on or are intolerant to a hedgehog pathway inhibitor. These are exciting times for the company based on all the positive developments lately. With that in mind, would you consider adding REGN stock to your watchlist?

Read More

-

Top Industrial Stocks To Buy In May 2021? 4 Names To Watch

-

Good Stocks To Buy Right Now? 4 Advertising Stocks To Watch

Atossa Therapeutics Inc

Atossa Therapeutics Inc. is a clinical-stage biopharmaceutical company. The company focuses on developing therapeutics and delivery methods for breast cancer and other breast conditions. Its pipeline includes two programs, endoxifen and intraductal microcatheter technology. ATOS stock has risen more than 160% over the past month.

Earlier this month, the company announced that it is set to be added to the Russell 2000 and Russell 3000 Indexes. This will take place at the conclusion of the 2021 Russell Indexes’ annual reconstitution. The significance of this should not be understated. As it would present an important opportunity for the company to expand its presence among a broader group of investors.

This is an important milestone for the company. However, its underlying business prospects will remain the key factor that would dictate its stock price moving forward. On that front, Atossa has also received approval from the Swedish Medical Product Agency (MPA) to initiate a Phase 2 clinical study of its oral Endoxifen for the reduction of mammographic breast density. All things considered, is ATOS stock worth your attention at this point in time?

[Read More]

Top Undervalued Stocks To Buy In July 2021? 3 Leisure Stocks To Watch

Crispr Therapeutics

To sum up the list, we have another gene-editing company, Crispr. Basically, it focuses on the development of transformative gene-based medicines for serious diseases. The company develops its products using Cas9 gene-editing platform, which allows for precise directed changes to genomic deoxyribonucleic acid (DNA). CRSP stock has been trending as its core business is in the same gene-editing space as Intellia Therapeutics. CRSP stock currently trades at $154.62 as of 9:50 a.m ET in its Monday morning’s trading, up by over 8%.

Besides that, the company has also announced a strategic partnership with Capsida Biotherapeutics Inc. Essentially, both companies would research, develop, and manufacture in vivo gene editing therapies. These will be delivered with engineered adeno-associated virus (AAV) vectors for the treatment of familial amyotrophic lateral sclerosis (ALS) and Friedreich’s ataxia. This partnership could surface the potential to develop first-in-class gene therapies for patients with severe neurological disorders.

Furthermore, there was also a positive update regarding its partnership with Vertex Pharmaceuticals Inc (

NASDAQ: VRTX

) for the treatment of transfusion-dependent beta-thalassemia and severe sickle cell disease. The new data on 22 patients with a follow-up of at least 3 months, treated with the investigational CRISPR/Cas9-based gene-editing therapy, CTX001, shows a consistent and sustained response to treatment. This progress and momentum of CTX001 validate the role that CRISPR gene-editing tech could have in the future of therapeutics. Hence, would you consider CRSP stock to be a top biotech stock to buy now?