Evelo Biosciences, Inc.

EVLO

announced positive data from a phase II study evaluating its oral pipeline candidate, EDP1815, versus placebo for the treatment of mild and moderate psoriasis, an inflammatory skin disease.

Data from the same showed that treatment with EDP1815 led to a clinically and statistically significant reduction in the Psoriasis Area and Severity Index (“PASI”) score, as measured by the proportion of patients achieving at least 50% improvement in PASI from baseline at week 16 of treatment. The safety and tolerability data of EDP1815 was comparable to placebo in the study, with no serious adverse event being observed.

Based on the above data, the company is planning to advance EDP1815 for registration studies in psoriasis.

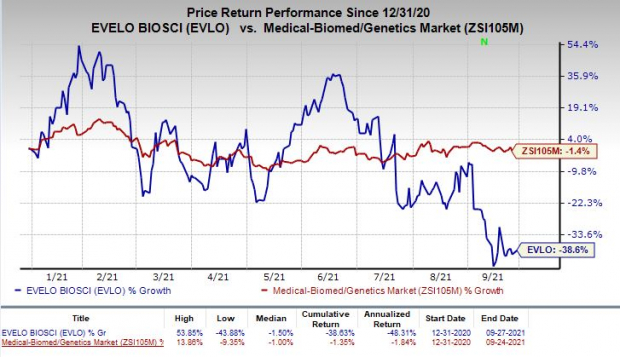

Shares of Evelo Biosciences were up in pre-market trading on Tuesday following the news. The stock has plunged 38.6% so far this year compared with the

industry

’s decrease of 1.4%.

Image Source: Zacks Investment Research

Apart from psoriasis, Evelo Biosciences is also developing EDP1815 for treating atopic dermatitis and COVID-19. The company plans to begin a phase II study on EDP1815 for treating atopic dermatitis shortly, with data from the same expected in the third quarter of 2022.

Evelo Biosciences currently has four product candidates in its portfolio. EDP1815, EDP1867 and EDP2939 are being developed for treating inflammatory diseases. EDP1908 is being developed for the treatment of cancer.

In the absence of a marketed product currently, successful developments of its pipeline candidates remain critical for the growth of the company in the long run.

Zacks Rank & Stocks to Consider

Evelo Biosciences currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector include

Spero Therapeutics, Inc.

SPRO

,

Corvus Pharmaceuticals, Inc.

CRVS

and

Vertex Pharmaceuticals Incorporated

VRTX

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Spero Therapeutics’ loss per share estimates have narrowed 8.2% for 2021 and 10.6% for 2022 over the past 60 days. The stock has inched up 0.4% year to date.

Corvus Pharmaceuticals’ loss per share estimates have narrowed 13.9% for 2021 and 7.2% for 2022, over the past 60 days. The stock has skyrocketed 115.5% year to date.

Vertex’s earnings estimates have been revised 10.2% upward for 2021 and 7.3% upward for 2022 over the past 60 days.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report