Shares of

Immunocore Holdings Plc

IMCR

were up 6.1% on Friday after the company announced that it has entered into a collaboration and supply agreement with French pharma giant,

Sanofi

SNY

.

Under this collaboration, the companies will evaluate Sanofi’s product candidate, SAR444245, in combination with Immunocore’s Kimmtrak in patients with metastatic cutaneous melanoma (mCM) — a population with significant unmet medical need.

Per the deal, as part of its ongoing phase I/II study, Sanofi will evaluate the combo of its precisely engineered version of IL-2, which is SAR444245 plus Immunocore’s novel bispecific protein, Kimmtrak, for treating HLA-A*02:01 positive patients with advanced unresectable or metastatic skin cancers.

Also, Immunocore will bear all the expenses related to the manufacturing and supply of Kimmtrak while SNY will be responsible for clinical development and all costs related to the above-mentioned study.

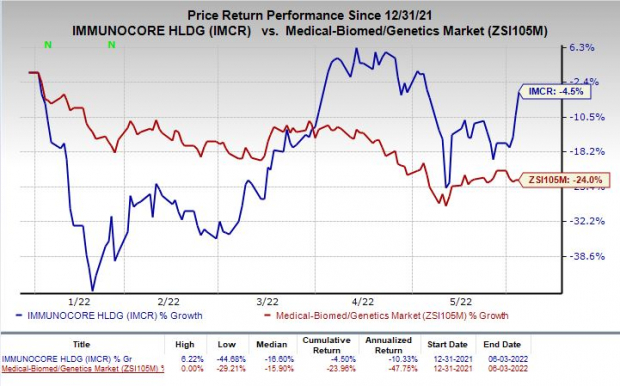

Shares of Immunocore have lost 4.5% so far this year compared with the

industry

’s decrease of 24%.

Image Source: Zacks Investment Research

In early 2020, Sanofi bought small cancer biotech, Synthorx, which added the latter’s lead pipeline asset, THOR-707 (now SAR444245) to SNY’s immuno-oncology portfolio. SAR444245 is currently being evaluated in several mid-stage studies for treating various types of cancer indications.

The FDA approved Kimmtrak for the treatment of HLA-A*02:01-positive adult patients with unresectable or metastatic uveal melanoma (mUM) in January 2022. In April 2022, the European Commission approved Kimmtrak for the given indication.

In the first quarter of 2022, combined net and pre-product revenues of Kimmtrak were £10.5 million or $13.8 million.

Immunocore is currently planning to initiate a randomized study investigating Kimmtrak with or without anti-PD1 therapy in patients with metastatic melanoma in the fourth quarter of 2022.

Successful development of Kimmtrak for additional indications will help the drug treat a broader patient population and drive sales in 2022 and beyond.

Zacks Rank & Other Stocks to Consider

Immunocore currently carries a Zacks Rank #2 (Buy). Other stocks worth considering in the biotech sector are

Leap Therapeutics, Inc.

LPTX

and

Anavex Life Sciences Corp.

AVXL

, both carrying the same Zacks Rank #2 at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Leap Therapeutics’ loss per share has narrowed 11.1% for 2022 and 5.9% for 2023 in the past 60 days.

Earnings of Leap Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion. LPTX delivered an earnings surprise of 1.92%, on average.

Anavex Life Sciences’ loss per share estimates narrowed 6.6% for 2022 and 4.3% for 2023 in the past 60 days.

Earnings of Anavex Life Sciences have surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions. AVXL delivered an earnings surprise of 0.48%, on average.

Free: Top Stocks for the $30 Trillion Metaverse Boom

The metaverse is a quantum leap for the internet as we currently know it – and it will make some investors rich. Just like the internet, the metaverse is expected to transform how we live, work and play. Zacks has put together a new special report to help readers like you target big profits.

The Metaverse – What is it? And How to Profit with These 5 Pioneering Stocks

reveals specific stocks set to skyrocket as this emerging technology develops and expands.

Download Zacks’ Metaverse Report now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report