Intercept

ICPT

announced positive top-line data from a new interim analysis of its ongoing pivotal phase III REGENERATE study, evaluating the efficacy of Obeticholic Acid (OCA) in patients with liver fibrosis due to nonalcoholic steatohepatitis (NASH).

This is the second analysis in which OCA has met its primary endpoint for the intent-to-treat (ITT) population in REGNERATE.

Based on the study’s results, Intercept will resubmit its new drug application (NDA) for OCA to treat liver fibrosis due to NASH.

The company stated that the primary endpoint of the new interim analysis of the ITT population from REGENERATE, which was conducted in 2,247 subjects, — fibrosis improvement without worsening of NASH at 18 months — was achieved with the 25 mg daily dose of OCA.

A greater proportion of patients in OCA treatment arm (taking doses of 25 mg) achieved the primary endpoint of NASH resolution with no worsening of liver fibrosis compared with placebo. However, this did not reach statistical significance.

The interim analysis population reiterated the original positive analysis announced in 2019.

However, in line with recent FDA guidance, the new interim analysis used a consensus panel approach to histology reads, while the original analysis relied on results from individual central readers.

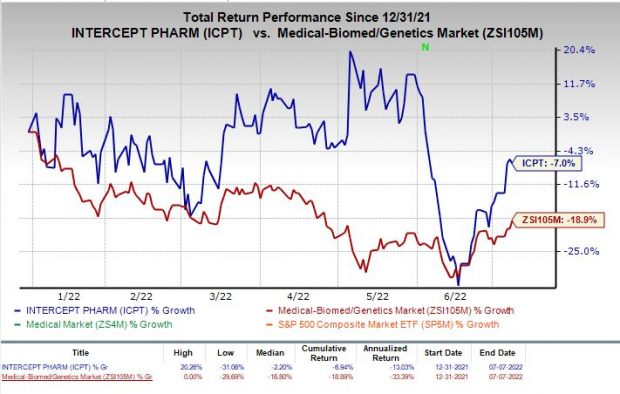

Shares of Intercept have declined 7% year to date, compared with the

industry

’s decline of 18.9%.

Image Source: Zacks Investment Research

Back in November 2019, Intercept announced that the FDA accepted its NDA for OCA, seeking approval for the treatment of fibrosis due to NASH. The regulatory agency also granted priority review and set an action date of Mar 26, 2020, for the NDA.

The NDA filing for OCA was supported by positive interim analysis results from the pivotal phase III REGENERATE study in patients with liver fibrosis due to NASH, reported by the company in February 2019.

However, Intercept received a complete response letter (CRL) from the FDA in June 2020, stating that NDA for OCA for the treatment of liver fibrosis due to NASH could not be approved in its present form.

Per FDA’s guidance, Intercept decided to resubmit the NDA along with supplemental data to further characterize OCA’s efficacy and safety profile, based on phase III REGENERATE 18-month biopsy data, together with a safety assessment from its ongoing studies.

However, last month, Intercept reported a delay in its pre-submission meeting with the FDA regarding the potential resubmission of its NASH NDA based on an interim analysis of the REGENERATE study in patients with fibrosis due to NASH.

Intercept’s pre-submission meeting with FDA is now set for later this month, where the company will resubmit its NDA for OCA in liver fibrosis due to NASH.

Zacks Rank and Stocks to Consider

Intercept currently carries a Zacks Rank #2 (Buy). Some similar ranked stocks in the overall health sector are

Aquestive Therapeutics

AQST

,

Aridis Pharmaceuticals

ARDS

, and

Merck & Co.

MRK

., each carrying a Zacks Rank #2. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Aquestive Therapeutics’loss per share estimates for 2022 have narrowed from $1.50 to $1.34 cents in the past 30 days. The same for 2023 has narrowed from 95 cents to 74 cents in the same time frame.

Earnings of Aquestuve missed estimates in one of the trailing four quarters and beat the same on the remaining three occasions, the average surprise being 13.78%.

Aridis Pharmaceuticals’ loss per share estimates for 2022 have narrowed from $1.78 to 34 cents in the past 30 days. The same for 2023 has narrowed from 75 cents to 60 cents in the same time frame.

Earnings of Aridis missed estimates in two of the trailing four quarters and beat the same on the remaining two occasions, the average negative surprise being 75.16%.

Merck’s earnings per share estimates for 2022 have improved from $7.28 to $7.32 in the past 30 days. The same for 2023 has moved south by a penny to $7.20 in the same time frame. Shares of MRK have returned 23.5% in the year-to-date period.

Earnings of Merck missed estimates in one of the trailing four quarters and beat the same on the remaining three occasions, the average surprise being 13.42%.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report