Jazz Pharmaceuticals

JAZZ

announced that it has initiated enrollment in a phase II basket study — EMERGE-201 — that will evaluate its new cancer drug, Zepzelca (lurbinectedin), as monotherapy for treating three different advanced cancer indications in three separate cohorts. The indications include advanced urothelial carcinoma, large cell neuroendocrine carcinoma of the lung, and homologous recombination deficient (“HRD”) tumors in patients whose disease has progressed following treatment with a platinum-containing regimen.

The company wants to evaluate the drug beyond its FDA-approved indication, metastatic small cell lung cancer (SCLC), in other difficult-to-treat cancers. The company believes that Zepzelca’s novel way of mechanism has the potential to treat metastatic or advanced solid tumors, which also have limited treatment options.

The EMERGE-201 study will evaluate Zepzelca monotherapy for objective response rate as its primary endpoint. The secondary endpoints include investigator-assessed progression-free survival, time-to-response, duration of response disease control rate and overall survival.

Please note that Zepzelca is approved under the accelerated pathway for metastatic SCLC. Jazz and its partner PharmaMar initiated the confirmatory study to support Zepzelca’s full approval in this indication in December last year.

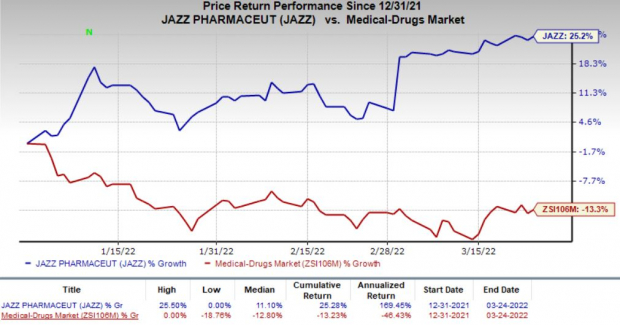

Jazz’s shares have risen 25.2% in contrast to the

industry

’s decrease of 13.3%.

Image Source: Zacks Investment Research

Jazz is also evaluating Zepzelca in combination with

Roche

’s

RHHBY

lung cancer drug, Tecentriq (atezolizumab), in a phase III study in patients with extensive-stage small-cell lung cancer.

Jazz is evaluating the combination regimen in collaboration with Roche. Tecentriq is Roche’s leading immuno-oncology drug for multiple indications.

Zacks Rank & Stocks to Consider

Jazz currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the same sector include

Collegium Pharmaceutical

COLL

and

Assertio Holdings

ASRT

, both sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

The stock of Collegium has risen 2.3% so far this year. The Zacks Consensus Estimate for Collegium’s 2022 earnings has gone up from $3.79 to $5.76 over the past 60 days.

Collegium delivered a negative earnings surprise of 57.55%, on average, in the past four quarters.

Estimates for Assertio Holdings’ 2022 earnings have improved from 20 cents per share to 35 cents per share over the past 60 days. ASRT stock has gained 35.7% so far this year.

Assertio Holdings delivered an earnings surprise of 20.83%, on average, in the past four quarters.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +25.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report