Vertex Pharmaceuticals Incorporated

VRTX

announced that the FDA has lifted the clinical hold placed on the phase I/II study evaluating its investigational stem cell-based therapy, VX-880, for the treatment of type I diabetes (T1D) with impaired hypoglycemic awareness and severe hypoglycemia.

Following this latest development, the early-stage study will now be restarted for screening, enrollment and dosing of patients at multiple sites in the United States.

Three patients have been treated in the phase I/II study till date.

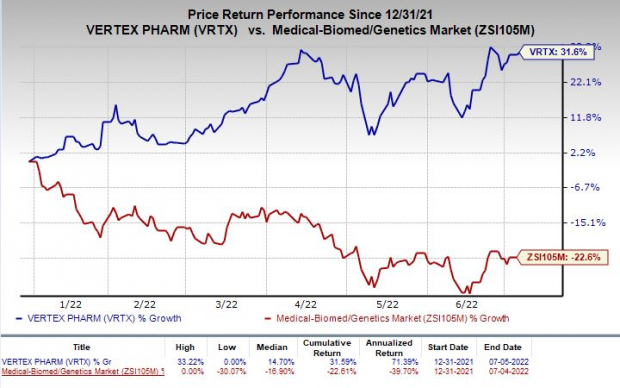

Shares of Vertex have rallied 31.6% so far this year against the

industry

’s decline of 22.6%.

Image Source: Zacks Investment Research

In May 2022, VRTX announced data from the phase I/II study on VX-880 for treating T1D. Along with the data, the company announced that the FDA had placed a clinical hold on the study due to a determination that there is insufficient information to support dose escalation with the product

VRTX announced data from the first three patients treated till date in the phase I/II study. The first patient, who received VX-880 at half the target dose, achieved insulin independence at day 270, with a HbA1c of 5.2%. The second patient, who also received a half dose of VX-880, showed robust increases in fasting and stimulated C-peptide, along with reductions in exogenous insulin requirements through day 150. Overall, results from the two patients demonstrated proof of concept for VX-880. The third patient, who received a full dose of VX-880, reached the day 29 milestone, which encouraged early indications of efficacy, with increasing C-peptide levels and improving glycemic control.

Back then, the Independent Data Monitoring Committee reviewed the totality of the safety and efficacy data from the first two patients dosed in part A of the study and recommended advancement to part B, where patients receive the full target dose of VX-880.

The FDA has granted a Fast-Track Designation to VX-880 for TD1. The designation facilitates the development and expedites the review of drugs that treat serious conditions.

VX-880 is Vertex’s first of the two investigational programs for the transplant of functional islets into patients. VX-880 is for the transplantation of islet cells alone, using immunosuppression to protect the implanted cells. The second program will involve the implantation of the islet cells inside an immunoprotective device. Clinical development on the second program is expected to begin later in 2022.

Zacks Rank & Stocks to Consider

Vertex currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector are

Leap Therapeutics, Inc.

LPTX

,

Aeglea BioTherapeutics, Inc.

AGLE

and

Precision BioSciences, Inc.

DTIL

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Leap Therapeutics’ loss per share has narrowed 11.1% for 2022 and 5.9% for 2023 in the past 60 days.

Earnings of Leap Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion. LPTX delivered an earnings surprise of 1.92%, on average.

Aeglea BioTherapeutics’ loss per share estimates narrowed 19.4% for 2022 and 37.5% for 2023 in the past 60 days.

Earnings of Aeglea BioTherapeutics have surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions. AGLE delivered an earnings surprise of 9.47%, on average.

Precision BioSciences’ loss per share estimates narrowed 26.2% for 2022 and 42.6% for 2023 in the past 60 days.

Earnings of Precision BioSciences have surpassed estimates in each of the trailing four quarters. DTIL delivered an earnings surprise of 76.15%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report