Hologic, Inc.

HOLX

has been gaining from robust growth in its diagnostics business. The launch of its expanded Omni suite during the fourth quarter of fiscal 2021 buoys optimism. Meanwhile, the growing uptake of Brevera in the company’s Breast Health segment is an added advantage. However, escalating expenses and forex woes do not bode well for the company.

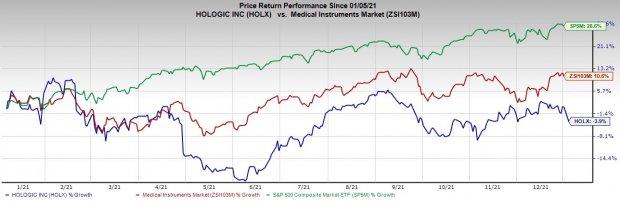

Over the past year, the Zacks Rank #3 (Hold) stock has lost 3.9% against the 10.6% rise of the

industry

and 28.6% rise of the S&P 500.

The renowned medical device company has a market capitalization of $18.38 billion. Its earnings for fourth-quarter fiscal 2021 surpassed the Zacks Consensus Estimate by 64.3%.

Over the past five years, the company’s earnings have registered a 34.1% increase, way ahead of the industry’s 3.3% rise and the S&P 500’s 2.8% increase. The company’s long-term expected growth is estimated at 13.0%, compared with the industry’s growth expectation of 15.9% and the S&P 500’s estimated 11.7% growth.

Image Source: Zacks Investment Research

Let’s delve deeper.

Factors At Play

Molecular Diagnostics Grows:

We are upbeat about the consistent growth in Hologic’s diagnostics business amid lower COVID-19 tests sales. In the fiscal fourth quarter, revenues at the Cytology & Perinatal rose 3.1%, while Blood Screening revenues increased 87.4% year over year. Worldwide Diagnostics revenues rose 5%. During the fiscal fourth quarter’s earnings call, the company noted that COVID-19 testing revenues exceeded its expectations as the Delta variant surged through the quarter. Notably, Hologic shipped nearly 21 million COVID tests to customers in the reported quarter, generating assay revenues of $443 million globally.

Strength in Breast Health:

Hologic has been making impressive progress in its Breast Health arm over the past few months. Revenues in this arm improved 15.6% from the year-ago period, led by a robust product portfolio and strong demand for Brevera following its relaunch. Impressive performance by the segment’s Breast Imaging and Interventional Breast Solutions also drove the top line. Global revenues grew 15% as the business rebounded from a weak prior-year period and showcased its increasing diversity in the face of the latest Delta surge. The company’s Genius 3D mammography systems continued to gain market share during the quarter. Despite COVID-19 pressure, Hologic placed almost 950 3D units in the United States in 2021.

Strength in GYN Surgical:

Revenues at Hologic’s GYN Surgical business rose 21.8% year over year, while revenues at Skeletal Health increased 26.9% year over year. In September 2021, the company launched an expanded Omni suite, a comprehensive gynecological surgical offering designed to optimize diagnostic and operative hysteroscopy in Europe, Africa and the Middle East. Another notable development in the GYN Surgical business includes Hologic’s recent agreement to acquire Bolder Surgical for $160 million to expand its surgical franchise. The company is also gaining significantly from its newly launched products like its latest CE-marked Fluent fluid management system, new hysteroscopes and ProVu.

Downsides

Escalating Costs:

During the fiscal fourth quarter, adjusted operating expenses, as stated by Hologic, surged 27.7% year over year. These mounting operating costs are building pressure on the bottom line.

Foreign Exchange Headwinds:

Hologic’s overall performance has been affected by unfavorable foreign currency impact in the past few quarters. We are worried about the significant challenges that the company faces given such adverse forex fluctuations.

COVID-19 Revenue Uncertainty:

Hologic is one of the key players working to produce or have produced tests for COVID-19. This may lead to the diversion of customers, including governmental and quasi-governmental entities, away from Hologic and toward other companies. Hologic is also witnessing a decline in its COVID-19 testing revenues following the vaccine rollout.

Estimate Trend

Over the past 60 days, the Zacks Consensus Estimate for Hologic’s fiscal 2022 earnings has moved 0.3% north to $3.70.

The Zacks Consensus Estimate for its fiscal 2022 revenues is pegged at $3.90 billion, suggesting a 30.7% fall from the year-ago reported number.

Key Picks

A few better-ranked stocks in the broader medical space that investors can consider are

Apollo Endosurgery, Inc.

APEN

,

Cerner Corporation

CERN

and

West Pharmaceutical Services, Inc.

WST

, each carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Apollo Endosurgery has a long-term earnings growth rate of 7%. The company‘s earnings surpassed estimates in the trailing four quarters, delivering a surprise of 25.6%, on average.

Apollo Endosurgery has outperformed its industry in the past year. APEN has gained 135.7% compared with the industry’s 10.5% growth.

Cerner has a long-term earnings growth rate of 13.3%. The company’s earnings surpassed estimates in the trailing three of the last four quarters and met estimates in one. Cerner has a trailing four-quarter earnings surprise of 3.2%, on average.

Cerner has outperformed its industry in the past year. CERN has gained 18.7% against the industry’s 39.4% decline.

West Pharmaceutical has a long-term earnings growth rate of 27.6%. The company’s earnings surpassed estimates in the trailing four quarters, delivering an average surprise of 29.4%.

West Pharmaceutical has outperformed its industry in the past year. WST has rallied 53.2% compared with the industry’s 15.4% rise.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report